Hi Experts,

I am software professional, filled ITR1 online on 27/07/11 for AY 2011-12 with a mistake that i provided details of Tax deduction from my employer under 'Advance Tax' instead of 'TDS'. Received Intimation U/S 143(1) on Nov 11 with no refund. But i am expecting the refund.

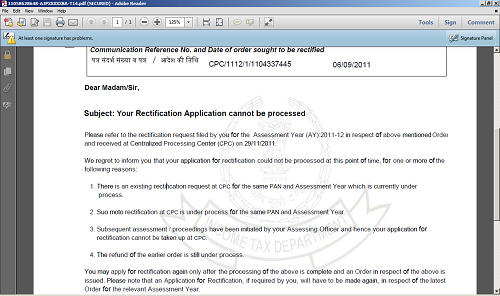

Now, I am filling rectification online with no change in Income or salary details, only making the 'Advance tax' as zero and 'TDS' amount as tax deducted amount.

Need help on below queries on ITR1 excel sheet “2011_ITR1_r10.xls” for filling rectification

- What would be “Return filed under section” – Initially it was filled under ‘11 - u/s 139(1)’

- Under section ‘Whether original or revised return?’ – what would be selection original or revised

- If revised then ‘If revised, enter Receipt no / Date’ which receipt number it is asking (E-Filling acknowledgement no. or the Communication Reference No. )

- On 'Submit Your Rectification Return' form of https://incometaxindiaefiling.gov.in/. On second page what would be 'Rectification Request Type' & 'Schedules Being Changed' component to be selected.

Need your Help in this regard.

Regards & Thanks

Sumit

CAclubindia

CAclubindia