Hi All,

I have two Form-16, one from company X(April 2016-August 2016) & other from Y(September 2016-March 2017), Company X did show HRA deduction, so I manually deducted it from Gross Total Income(6+7), then filed ITR. Now ITR has sent me a mail with the following subject seeking for clarifications:-

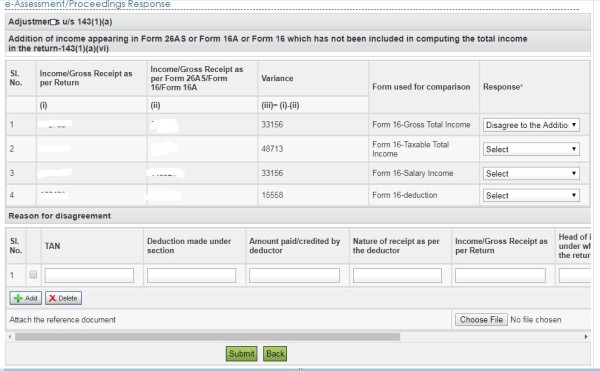

Subject: Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961.

Please tell me how to fill reason DISAGREE TO THE ADDITION, as i do not know how to fill the given fields:-

a. TAN: (Should it be my Employer's TAN?)

b. Deduction Made under section

c. Amount paid/credited by Deductor

d. Nature of receipt as per Deductor

e. Income/ Gross Receipt as per Return

f. Head of Income/ Schedule under which reported in the Return

g. Reason: (In my case should I select Deductions claimed in the return but not in Form 16?)

h. Justification/ Remarks (I understand I have to explain the details in here)

What will happen, if I click SUBMIT?

Will it be subimitted, or I will get a final SUBMIT option as there are four fields I disagree with ?

?

Thanks & Regards

Siddhartha Banik

Attached File : 2050533 20170729133104 capture.jpg downloaded: 512 times

CAclubindia

CAclubindia