Dear Tax Payers and Tax Consultants.,

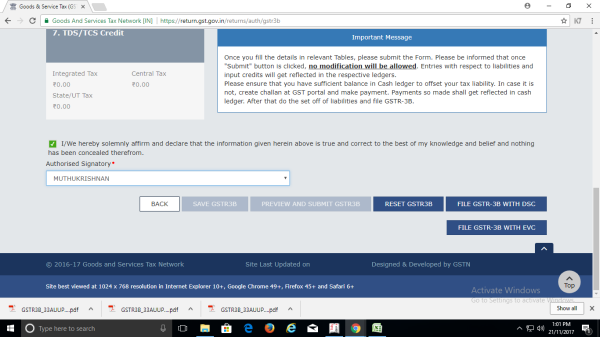

>>> In October Month GSTR 3B return "RESET GSTR 3B" option Activated on Before filing or After Submitting...

>>> GSTR 3B Return Form available in "DOWNLOAD FILED RETURN".

>>> "RESET GSTR 3B" option is enabled. But, Not Activated. "Available SooooooooooooooN".

CAclubindia

CAclubindia