Hi Financial Experts

I am trying to file income tax for FY 20-21 online. In the process tried to check with Form26AS and found the new terminology that is SFT(Statement of financial transaction)

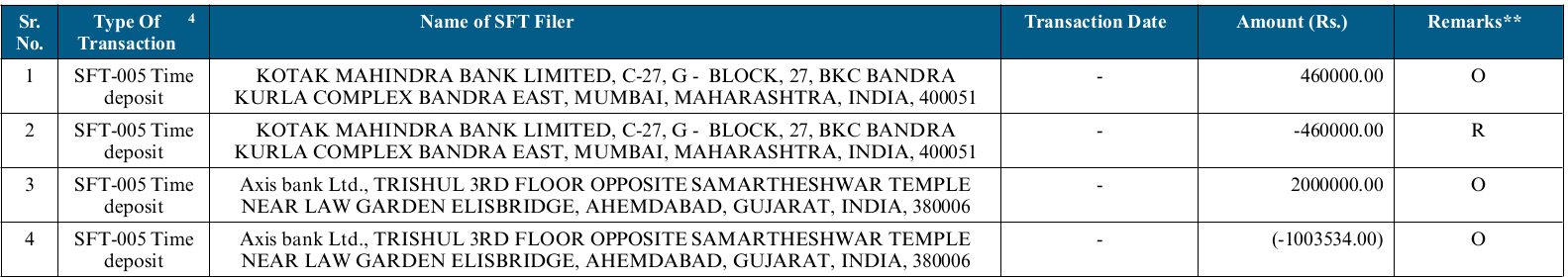

Please find the below screenshot of my SFT from Form26AS

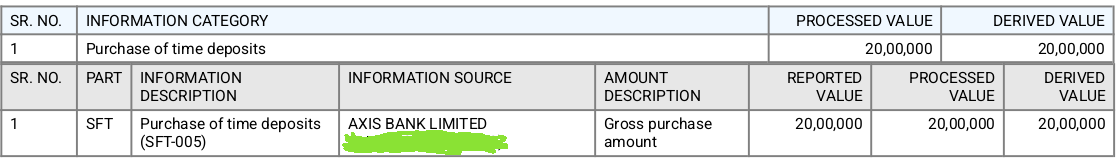

I could not understand it, how that 20L figure has come, please help on this. Not sure of that, so I checked the tax payer information summary but again it has shown 20L. Please find the below screenshot

What is Gross Purchase amount?

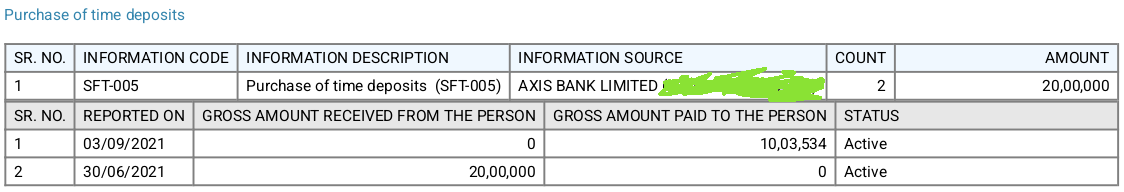

Lastly, I have checked it in annual info statement. Please find the below screenshot.

The figure Rs.10,03,354/- got resolved from my bank account statement, this is clearly FD interest I know. Please find the below image.

But not sure of 20L, how it appeared

Questions please

- What is Gross amount received from the person and gross amount paid to the person

- Please help me understand about that 20L, how it has arrived, I never had 20L in my account so far. Please clarify on this

- As in the first screenshot what is O and R mean, can you please help me understand

- And while filing ITR-1 returns how should I consider this information SFT-005, do I have to add this info anywhere while e-filing returns

CAclubindia

CAclubindia