Hi guys,

I joined a company in May 2017 as a software developer in Hyderabad and I was not working in India for past two years so I have no knowledge of tax deductions in India so please bear with me. Following is the salary breakdown offered to me, CTC agreed before joining was 9.5LPA:

|

Components

|

Monthly

|

Yearly

|

|

Basic

|

47000

|

564000

|

|

House Rent Allowance

|

21150

|

253800

|

|

Medical Allowance

|

1250

|

15000

|

|

Conveyance

|

1600

|

19200

|

|

Bonus

|

0

|

0

|

|

Performance Allowance

|

2847

|

34162

|

|

Personal Allowance

|

2847

|

34162

|

|

Gross( A)

|

76694

|

920324

|

|

EMPLOYER CONTRIBUTIONS

|

||

|

PF

|

1800

|

21600

|

|

PF Admin charges

|

173

|

2076

|

|

GPI

|

500

|

6000

|

|

ESI @ 4.75% on Gross

|

0

|

0

|

|

Sub Total (B)

|

2473

|

29676

|

|

CTC ( A+B)

|

79167

|

950000

|

|

EMPLOYEE CONTRIBUTIONS

|

||

|

PF 12% @ Basic

|

1800

|

21600

|

|

ESI @ 1.75% on Gross

|

0

|

0

|

|

Professional Tax

|

200

|

2400

|

|

Sub Total (C)

|

2000

|

24000

|

|

Net Salary (A-C)

|

74694

|

896324

|

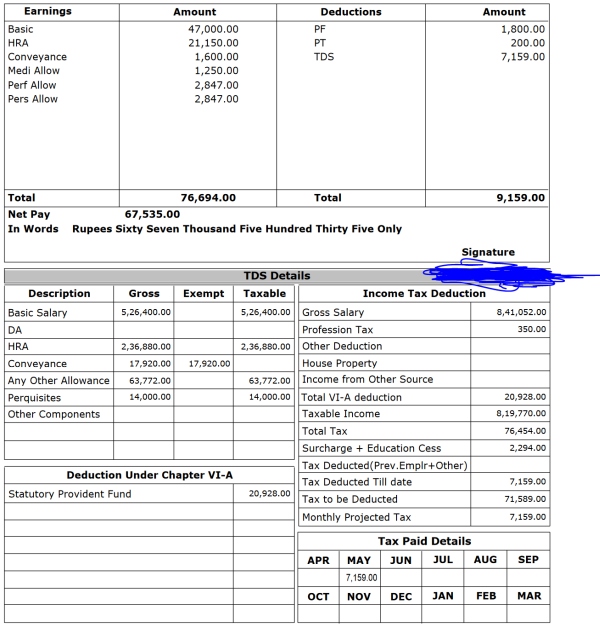

My payslip of may 2017 below, my employer "forgot" to include my declarations so full tax got deducted:

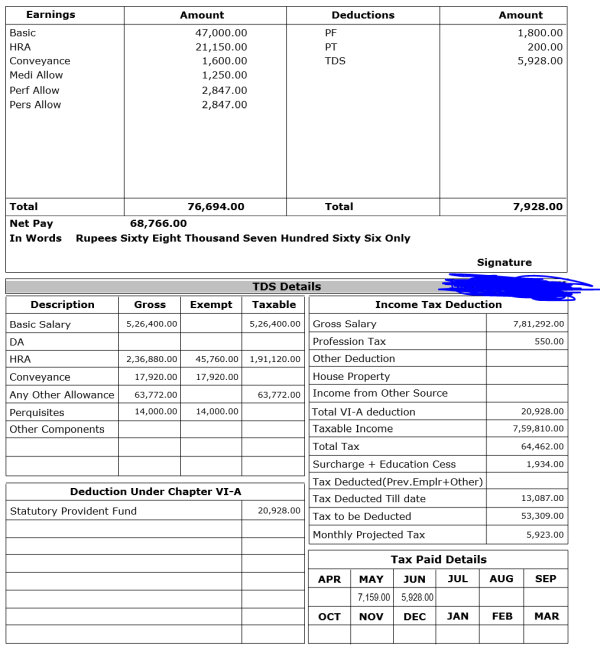

My payslip of june 2017 below, declared 98000 as yearly HRA and 15000 as yearly medical in the declaration form:

My questions:

- Is the tax calculation correct inclduing the 98000 HRA declaration? I cannot see medical excemption even though I declared 15000 of it.

- Notice the "Profession Tax" increasing every month, I thought profession tax is fixed at 200 but its 350 for may, 550 for june and for july they deducted 750.

- My PF account is getting credited with 2300 but as per my undestanding, total contribution from both employer and employee is 3600 so 3600 should get credited.

I can't help but feel the deductions are not calculated properly and there are additional hidden deductions (like the professional tax increasing every month), so please help me out.

CAclubindia

CAclubindia