Hello Everyone ..

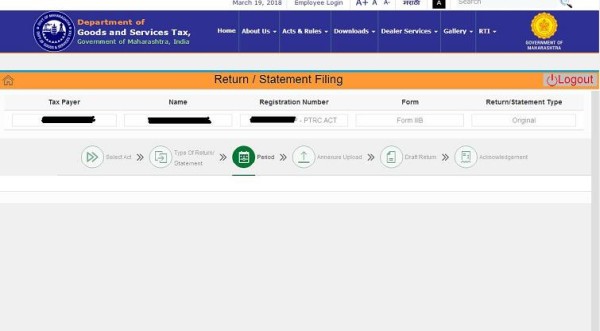

I downloaded the latest return template from mahagst new automation site. Now while trying to upload the return file ... I am not able to get past the screen to select Period of return. Please see attached snapshot. There is no calender / date to select or enter the period to continue. Is anyone else facing this problem ?

Thanks in advance :) ... Shab

CAclubindia

CAclubindia