Menu

Penalties and FINE

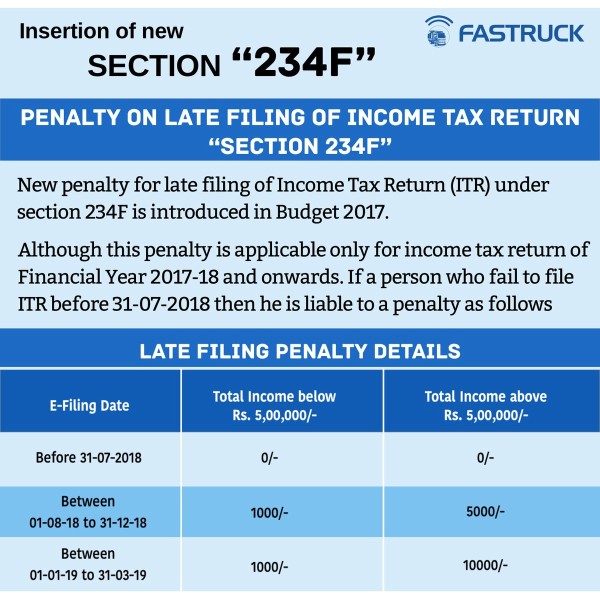

Is fine will be imposed If we file direct tax return with income below taxable after 31 st july?

Replies (5)

Recent Threads

- Section 44AB is Gone — How Different is Tax

- Capital Gains from Cancelled Residential Project

- Import of goods data in IMS

- GSTr 9 24-25

- Change HSN

- TDS ISSUE ( DIFFERENT SECTION )

- Company strike off with loan waiver accounting iss

- Board resolution for authorization for GST

- Invoice related audit

- Gst input credit related

Related Threads

CAclubindia

CAclubindia