It is quite possible that you receive a notice from the Income-Tax Department for old dues or ambiguous income. Sending scrutiny notice under section 143 (3) has become a style for the department to develop seriousness in people regarding tax compliances.

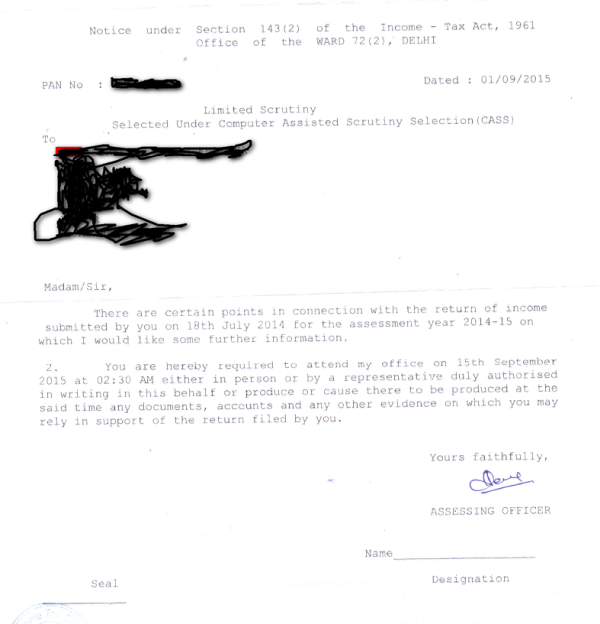

Notices are also served on demand of the individual after applying for a rectification petition during filing of return under section 154, most probably due to mismatch in TDS or income amount, as well as when the details required are not specified under section 143 (2) of the Income-Tax Act, 1961. The AO (Assessing Officer) can make a regular assessment after a detailed enquiry under section 143 (2).

Notice under section 143 (1) is served to the assessee regarding intimation about the calculation mistake or error in filing return or claiming excessive deduction or wrong exemption found in processing of income tax return. The purpose is to inform the person about the difference between the return filed by him and the computation as per the IT department, which result in creating the situation of amount payable or amount refundable.

Do not panic and never try to ignore the notice. Because this ignorance may lead to a fine, that can be extended up to Rs 10,000, apart from the penalty of tax and interest. So, as per the notice, you must meet the AO with all the relevant documents. Following points should be taken care of before meeting the assessing officer:

Understand the motive of serving the notice.

Check the given details of notice, i.e., your name, address, PAN, etc. It may happen that your name or address is printed incorrectly but the PAN number is enough for the IT department to identify you.

The notice also contains details of officer in-charge like name, designation, signature and office address with income tax ward/circle number. Keep these in view to escape from being cheated.

Now, the trend of electronic notices has started. Therefore, check 'document identification number' available on each communication with tax authorities.

Check the validity of the notice as well as the duration within which you have to respond to the AO. Usually, a scrutiny notice has to be served to the assessee within a period of six months from the end of the financial year. It may be possible that under section 148, a notice related to very old cases are sent because of being reopened by the AO due to genuine reasons.

Retain some copies of the notice.

Preserve the envelope of the notice. It contains the Speed Post number and date of posting and serving of notice to you. It will be helpful when you receive the notice late and fail to respond within the valid period.

Collect all the required documents and make a cover letter containing a list of all the annexed documents with necessary details. Retain a photocopy of that file for future reference.

In the case of notice under section 143 (2), collect the basic documents related to major expenses, income and loan details, bank statements, etc.

Submit the file and ask for the acknowledgement on a copy of the cover letter attached to the file and preserve it. It acts as an evidence of submission of the concerned articles along with details of each document.

If some of your old dues come out after the process, they can be adjusted against your pending refunds, if claimed.

If the case is complicated, it is better to take the help of a professional like CA, CS, advocate etc. He will make you understand about the demand in the notice and about the supporting documents needed. A professional will also help in preparing an appropriate response at the time of appearing before the AO and things might get resolved with ease.

In your case, the notice issued is well within the time limit, however the notice does not contain details of ao. Did you receive through email? Check the din no, then Also the timings to call you is also not within the working hours also.

CAclubindia

CAclubindia