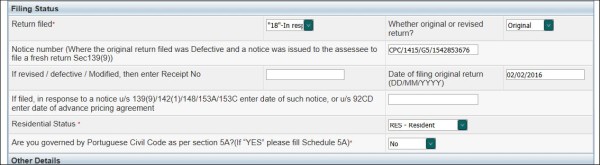

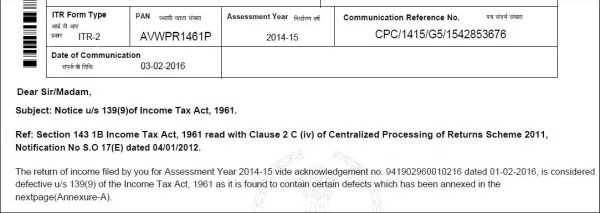

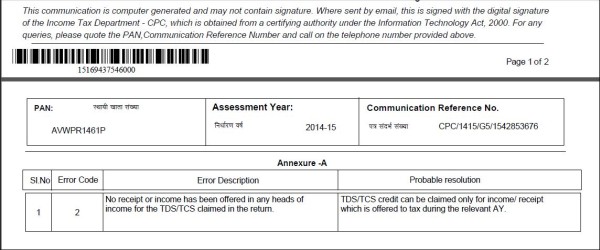

Dears, I got notice u/s 139(9) from CPC, Bengaluru. Error described is 'No receipt of income has been offered in any heads of income for the TDS/TCS claimed in return'. TDS claimed is for Interest of Bank FD . I filed ITR 2 on behalf of my wife who has no income. What is the resolution available to the same? Please help as I have to comply within 15 Days. Please find the ITR2 Form below.

Menu

Notice u/s 139(9)

Replies (8)

Recent Threads

- Capital Gains from Cancelled Residential Project

- Import of goods data in IMS

- GSTr 9 24-25

- Change HSN

- TDS ISSUE ( DIFFERENT SECTION )

- Company strike off with loan waiver accounting iss

- Board resolution for authorization for GST

- Invoice related audit

- Gst input credit related

- Updated ITR as missed the dead line

Related Threads

CAclubindia

CAclubindia