India growth story is most talked about and why not? The country’s GDP is pegged to grow at a rate of more than 7.5%. India’s Stock market has given the best returns in the last 6-8 months of more than 60%. The household savings continues to be as high as 35% inspite of slowdown and recessionary pressures. Forex reserves have increased by more than 10billion $ in the 1st quarter and the total reserves are up, to 262 billion $. Current Budget focuses on reducing fiscal deficit by the measures of disinvestments and improving the infrastructure of the country. Overall the country is all set to grow at a rapid pace and the government has laid a strong foundation for this. Having realized this, one can strongly say that sufficient liquidity has to be maintained in the system to enhance credit and economic growth.

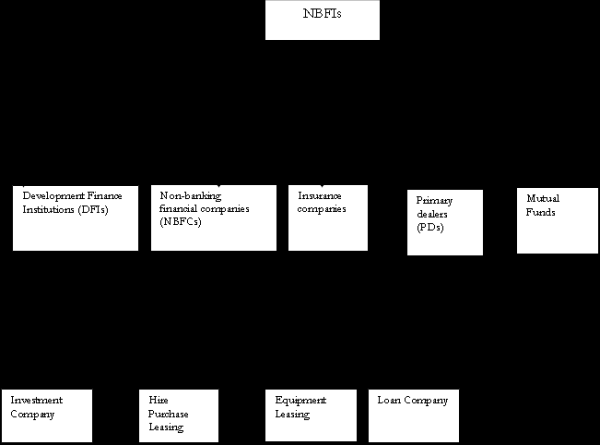

NFBIs (Non Banking Financial Institutions) play an important role in realizing the economic growth. They have access to larger markets and provide financing for almost all activities.

Think of buying an automobile, and one will find financing companies that provide EMIs at the doorstep. Think of buying any electronics, one would be amazed the number of financing companies that one can approach to make a deal. Thus the competitiveness of the companies combined with fierce penetration across the length of the country enables NBFIs to grow at a rapid pace.

In the following document, NBFIs in India are discussed with a focus on NBFCs. The total assets managed by NBFCs amount to 95,727 crore as on June 2009. This accounts for around 9.1 % of assets of the total financial system [1]. Hence the business carried out by NBFCs is of great importance for overall development of the country. Thus RBI is implementing various schemes and policies for maintaining enough liquidity for funding requirements. Also various regulations are levied on NBFCs for making the overall system robust.

CAclubindia

CAclubindia