Menu

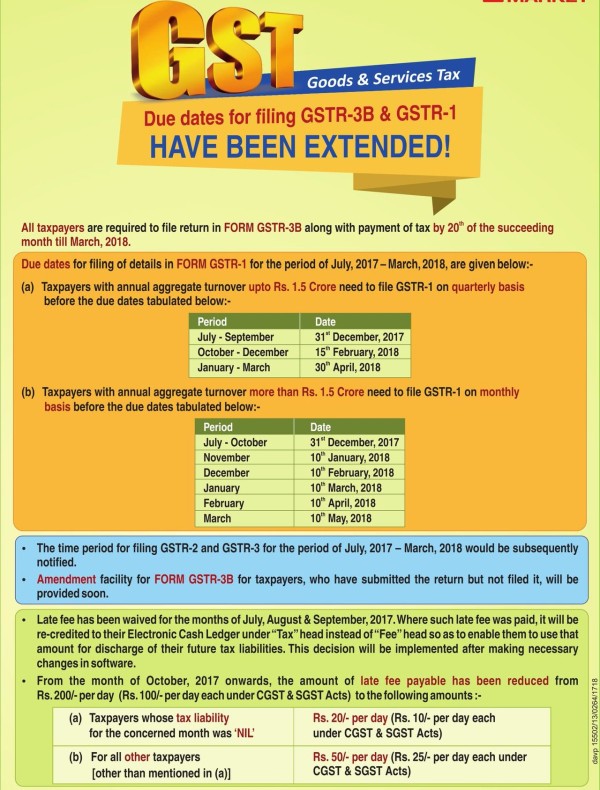

last date for GSTR 1 SEPT

please tell me last date for sept gstr 1

Replies (4)

Recent Threads

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

- Capital Gains from Cancelled Residential Project

- Import of goods data in IMS

- GSTr 9 24-25

- Change HSN

- TDS ISSUE ( DIFFERENT SECTION )

Related Threads

CAclubindia

CAclubindia