Hi Everyone,

I am an exporter of services. Everything is sold digitally, so there is no shipping bill.

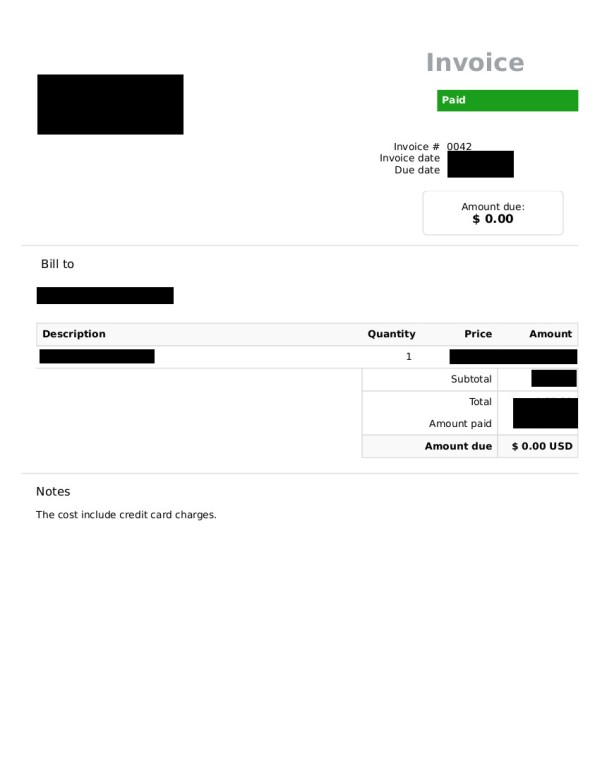

Only thing I have is invoices generated by paypal when the clients paid me.

Please check the attached invoice.

Can I fill the invoice no. as on the attached image .e.g 0042 in GSTR-1 invoice field?

thanks

CAclubindia

CAclubindia