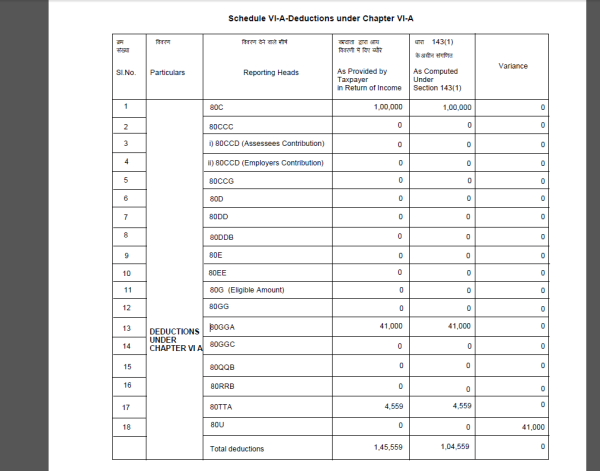

I got notification under us/143 for AY 2014-15. In this there is a variance shown under chapter VI-A

Though variance shown under section 80U for amount is 0 from myside as well as from Tax department 0 = still in the variance column it is showing 41,000. i suspect it might be related to 80GGA column though there are also both the amount are mataching and variane is zero (but amount claimed is 41000). I do not know what to do because of this my refund got reduced. Any help or suggestion on this.

Thanks,

CAclubindia

CAclubindia