Menu

INPUT FOR THE FINANCIAL YEAR 2018.2019

we have made purchases (large purchases)during the F Y 2018.2019 Under IGST and claimed input

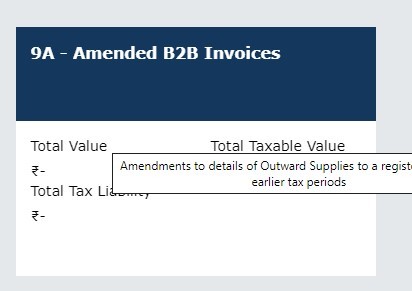

without verifying 2A.Now we have reconciled with 2A One of the supplier filed GSTR 1 considering us as a Unregister dealer eventough we have mentioned our GSTR Number on purchase order approximately 12lacs IGST Each one lack.My qtn is whether our supplier can modify the GSTR 1 REURN so that we can avoid reverse of input and make payament through bank.

without verifying 2A.Now we have reconciled with 2A One of the supplier filed GSTR 1 considering us as a Unregister dealer eventough we have mentioned our GSTR Number on purchase order approximately 12lacs IGST Each one lack.My qtn is whether our supplier can modify the GSTR 1 REURN so that we can avoid reverse of input and make payament through bank.

Replies (8)

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia