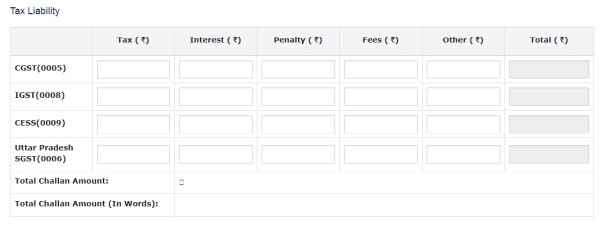

In which column we can pay our gst reverse charge and 1 percent of the income. When we create invoices, there are many columns coming in, including tax, intrest, penalty, fee and other columns.

Please try to guide.

Menu

In which column we can pay our gst reverse charge

Replies (7)

Recent Threads

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

Related Threads

CAclubindia

CAclubindia