Software Engineer

54 Points

Joined March 2018

Sir, I am posting the complete picture from that thread for your convenience.

I am a Salaried employee ( 6 months in this financial year ). I have day Trading losses of 60000 with an annual turnover of 220000. Short term capital gains are also present.

I am writing here my understanding of taxation. Please correct me wherever i am wrong.

- Day Trading is a speculative business Income. Tax audit is necessary in my case as total turnover is 220000 ( < 2 crores ) and Net profit is -60000 ( < 6% of Total turnover ). Use of ITR 2 is not possible if i report my losses.

- ITR 4 is ruled out as I also have to report STCG ( Rs. 15000 ) under Schedule CG.

- To be fully compliant, I have to use ITR 3 and get the tax audit done.

I am not interested to carry forward the losses and my Primary objective is to avoid tax audit. Here i seek advise from all of you. I feel, I have following options :

- Use ITR 2, Report STCG and Salary income, Ignore day trading losses. ( Please remember i am not interested to carry them forward, I just want to avoid tax audit )

- Use ITR 4, Report STCG under the head of ‘income from other sources’ and Pay taxes on 6% of my business turnover of 220000.

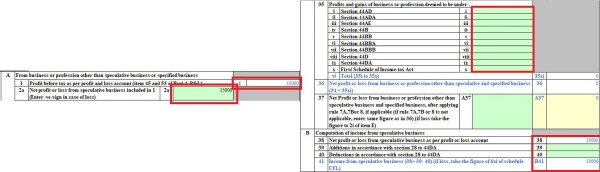

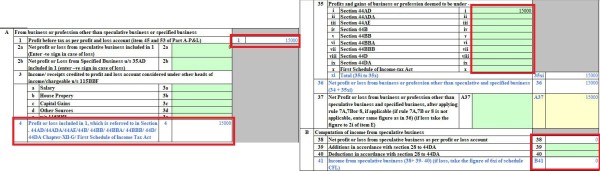

- Use ITR 3, Report STCG and Salary under appropriate schedule. Though i have incurred loss from day trading ( Business ), I report profit of more than 6% of my annual turnover ( In this way i can avoid tax audit ) and pay required taxes. ( 6 % of 220000 = 13200, 20% ( Tax Slab ) of 13200 = 2640 which is gold when i compare it with Tax Audit hassles. )

- Club the turnover and net profit from ‘Day trading’ and ‘Short term equity investment’, Declare myself as a businessman ( I feel i can do that as i have worked only 6 months this FY ) and Take presumptive business income route by using ITR 4.

Please advice me on what path to follow in order to avoid ‘wrath of IT Department’ as well as ‘Tax Audit’. Any other suggestions except above are most welcome.

Then a Member suggested me to take Approach No 3.

Follow-up Question that i posted on that thread were :

- Altough i have incurred loss, I have to declare profit of more than 6% of turnover. Is it legal in case of ITR 3 ? Can Section 44AD be applied even in case of ITR 3 ?

- If i file my profit under 44AD using ITR 3, Does it mean i have to file my business income ( Intraday + FnO ) atleast for next 5 years under this section only ?

- What if i stop trading and Shift to ITR 2 next FY. Will i be debarred from using 44AD subsequent FY or Ban is applicable when you are still filing your returns using ITR 3/ITR 4 but not under section 44AD ?

Eagerly waiting for your reply, Sir !

CAclubindia

CAclubindia