DEAR SIR, I AM PREPARING TDS FUV. FILE IN RPU FOR QUATER 4 SALARY. THE FOLLOWING DETAILS ARE THE SALARY STRUCTURE OF MY BOSS.

GROSS SALARY- RS.11,77,200/-

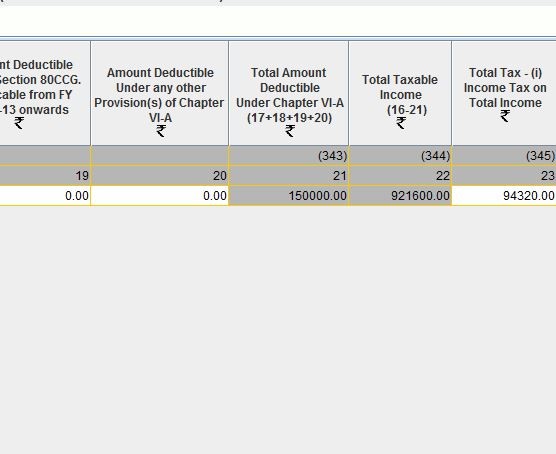

LIC+EPF=1,50,000/-

HOUSING LOAN INTEREST PAID TO BANK FOR F.Y. 2017-18=RS. 3,13,379/-

NOW MY QUESTION IS 1) HOW MUCH HOUSING LOAN INTEREST CAN BE CLAIMED?

2) WHERE TO MENTION THE HOUSING LOAN INTEREST AMOUNT IN ANNEXURE II OF 24Q?

CAclubindia

CAclubindia