Hi Friends,

I am in need of some quick help and specific info regarding the following sections of ITR2. I am filing ITR for the first time and doing it myself. My income is from Salary, Bank interest and Capital gains (actually some STCG to be carried forward). The reason I am doing it myself is to learn and be self educated on financial matters. (I am not from Commerce background)

I have read the intructions and understood ITR2 form to a certain level. However, I have some doubts/queries regarding the Capital gains section and Loss carry forward section.

If possible, Plz do the corrections in the following screenshots and upload the corrected ones. I will really be grateful and appreciate the help.

Now the queries in details:

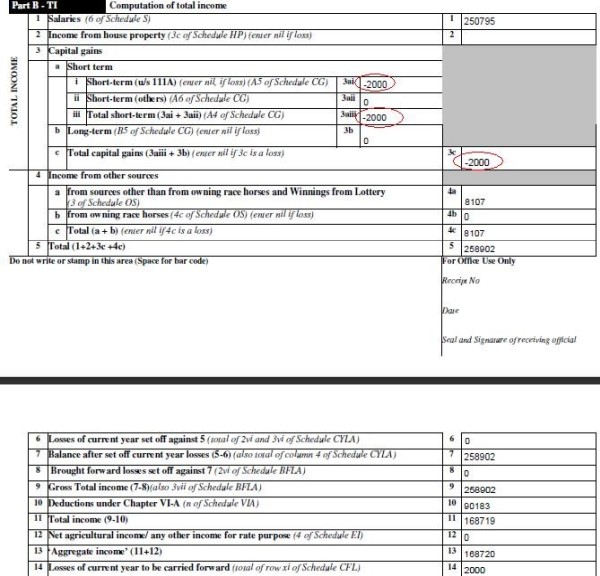

I have some Short Term Capital Loss from Shares/Securities. Using this example for clarifying -> Suppose I have bought shares worth for5000 and Sold them at3000 i.e, Loss of2000. I generated this sample ITR via TaxYogi.com (advertised on CaClub website):

1) Computation of Total Income section:

As per my understanding NIL should be entered in the Red-Circled areas. But as this was autogenerated, I got confused. Plz suggest the correct practice:

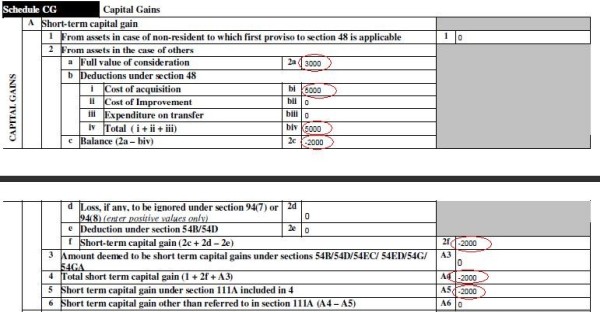

2) Ok. Now this is where I really am confused and need help. The Capital Gains section:

i) The Short Term Capital Gains section:

Are the following entries correct considering my example of Stocks bought for5000 and sold for3000. Should 3000 go to Full value of consideration? Should 5000 go to Cost of acquisition under section 48?? Are the negative values allowed here (-2000)?

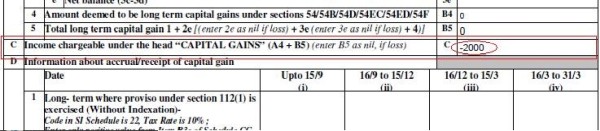

ii) Income Chargeable under the head capital gains:

It is mentioned to write NIL is loss. However, the website using which I have prepared this entered -2000 here. What is correct here?

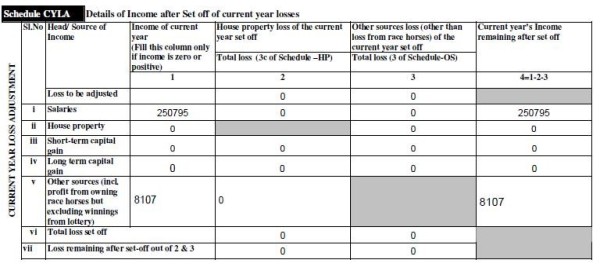

3) CYLA section. As I mentioned this is my first ITR. I have no carried forward loss from previous years. Is this section at all needed to be filled as in the image below?

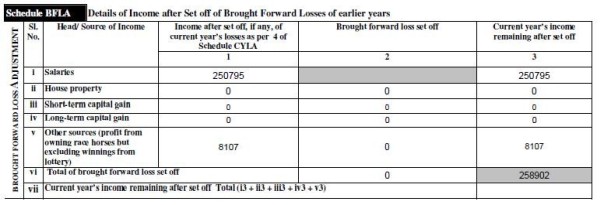

4) BFLA. Same query as point 3. Is this section at all needed to be filled?

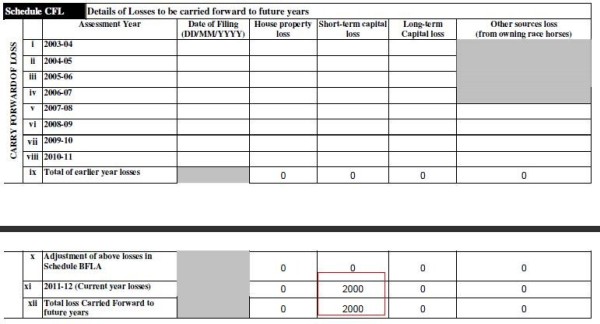

5) CFL. Is this correctly filled as per the sample info given above? :

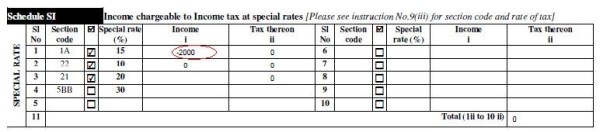

6) Special Rate - SI section. Is the -ve value correcly placed here? Does this needs to be specified?

I know this is a bit time taking to answer so many things. But, Plz help me :)

Another query:

- I availed medical reimbursement from employer of about7000. This is exempt from Tax upto 15000 per year.

I am refering to the following:

"Medical Reimbursement up to15,000

If an employee receives some money for his medical treatment or the treatment of any member of his family or any of his dependant relatives then a sum up to15,000 p.a. is not treated as a taxable perquisite as per Clause (b) of the provision to Section 17 (2) of the I.T. Act. This exemption is enjoyed by the employee only if the expenditure is actually incurred on his medical treatment or for treatment of any member of the family or a dependant relative. It may be noted here that there is no condition that the medical treatment should be at any of the approved hospitals. It could be at any place and from any type of doctor belonging to Allopathic, Ayurvedic, Unani or Naturopathy system of medicine. If medical allowance is received then it would be fully taxable."

This amount has not been included in Salary income in Form 16. And also I dont find any section in the ITR2 to show this amount. Any idea? Does this needs to be mentioned somewhere?

I will file the return online after recieving inputs from you.

Looking forward for some quick help.

Thanks a ton in advance :)

Original Post: /forum/urgent-plz-plz-help-itr2-cg-section-and-loss-carry-forward-158218.asp

CAclubindia

CAclubindia