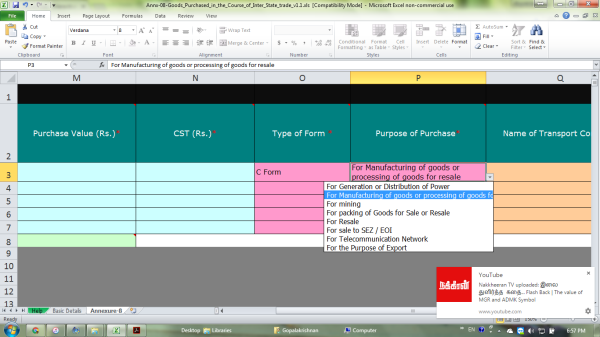

Whether Form C can be given for Fixed Asset purchase? the asset not for the purpose of manufacturing of goods.

Menu

Form c

Replies (8)

Recent Threads

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

- GST RATE OF OUT DOOR CATERING

- Non resident taxation & income tax in India

- GST Rate for oral Hygiene Combo Pack

- GST registration - Address error

- TDS on property pu

- Import of goods IMS action related

- Incometax Survey - Updated Return Filing after the

Related Threads

CAclubindia

CAclubindia