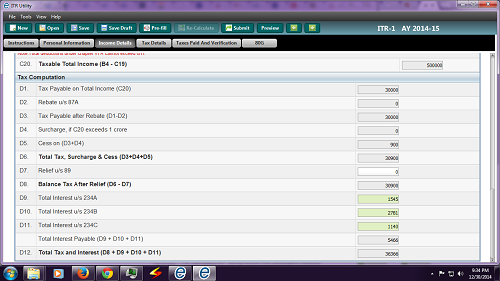

I am filing ITR for 2014-15 assesment Year (year ending March 31st 2013).

Apart for TDS for Salary - I had to pay interest income for my saving bank accounts for 33896-

Now, For that i had to pay 12310 Income tax (which includes the Penalty and interest for this amount)

While filling up 280 Challan My Bank Website is asking for the following:

Income Tax:

Surcharge:

Education Cess:

Interest:

Penalty:

Others:

Total:

I know i need to pay income tax of 12310 (which includes all the above)

How can i fill up the Challan.

Please help me.

CAclubindia

CAclubindia