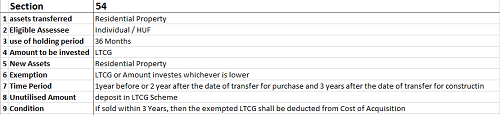

If a person sells his house to buy a new appartment as a residential property and the dealer promises to hand over the possession after 4 year (being the construction period), can the assessee avail exemtption u/s 54 (sal of one residential property to purchase another one and investing the total proceeds along with capital gain therein).?

Menu

Exemption u/s 54

Replies (2)

Recent Threads

- How to Increase Website Traffic Effectively

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

Related Threads

CAclubindia

CAclubindia