Student [I.C.A.I]

993 Points

Joined May 2008

Rule 12 of the Income Tax Rule determines which form should be used by a tax payer. CBDT has , while publishing new ITR- forms – also amended Rule 12 (1)(a) vide notification dt 5th April 2011 . The relevant amended portion related to ITR-1 i.e SAHAJ is given below :

12. (1) The return of income required to be furnished under sub-section (1) or sub-section (3) or sub-section (4A) or sub-section (4B) or sub-section (4C) or sub-section (4D) of section 139 or clause (i) of sub-section (1) of section 142 or sub-section (1) of section 148 or section 153A relating to the assessment year commencing on the 1st day of April, 2011 shall,—

(a) in the case of a person being an individual where the total income includes income chargeable to income tax, under the head,-

(i) “Salaries” or income in the nature of family pension as defined in the Explanation to clause (iia) of section 57; or

(ii) “Income from house property”, where assessee does not own more than one house property and does not have any brought forward loss under the head; or

(iii) “Income from other sources”, except winnings from lottery or income from race horses, be in Form SAHAJ (ITR-I) and be verified in the manner indicated therein;

In simple terms, please note that the aforesaid Rule 12 , sub clause 1(a) provides that ITR-1 (SAHAJ ) can be filed only by an individual having no income other than

1. Salary income or,

2. pension income or,

3. income from house property or

4. Income from other sources (other than winnings from lottery or horse race )

Important point to note is the fact that nowhere it is written that SAHAJ can not be filed by an individual having agriculture income in excess of Rs 5000

.

The confusion part

Let us take an example. Say , a person Mr X having following income only

1. Income from salary Rs3,50,000

2. Dividend Rs 50,000

3. Agriculture income Rs 2,00,000

Although agriculture income is tax free u/s 10(1) of the I T Act., yet it is taken for determination of tax rate purpose as stated in Chapter I of Finance Act if the agriculture income exceeds Rs 5000 .

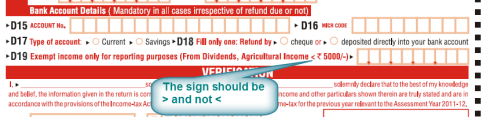

Therefore , Rs 2,00,000 was taken for computation of tax of Mr X as the tax rate in this case and the Individual also pays tax correctly. When he fills ITR-1 , he fills Rs ,2,50,000 in D19 which for exempt income.

The problem will come when his return will be processed u/s 143(1) by the I T department because the Assessing Officer will not know that Rs 2,00,000 out of such exempt income is from agriculture income. It is also be noted that the return is made annexure less , so there is absolutely no chance for an It officer to know the agriculture income portion in the exempt figure filled in return (D19).

This will create erroneous computation by department and shall lead to wrong demand creation or refund whatever be the case. It will increase workload of tax practitioner, crate anxiety in taxpayer and shall also increase non productive workload on income tax department .

Suggestion

There are simple solution for this.

1. Create a separate field for agriculture income exceeding Rs 5000 in SAHAJ Or

2. Rule 12 should be changed to include in sub-clause (a) of Clause 1 of Rule 12 that SAHAJ is not for persons who have agriculture income.

Such a provision was there earlier .For example Naya Saral Form 2E as early as Fy 2007-08 when Rule 12 was substituted by the IT (Fourth Amdt.) Rules, 2007, w.e.f. 14-5-2007 as under:

Provided further that in the case of an individual or a Hindu undivided family, resident in India, where the total income does not include income chargeable to income-tax under the head “Profits and gains of business or profession” or “Capital gains” or agricultural income, the assessee shall also have the option of filing the return in Form No. 2E : Naya Saral on or before 31st day of July, 2006

CAclubindia

CAclubindia