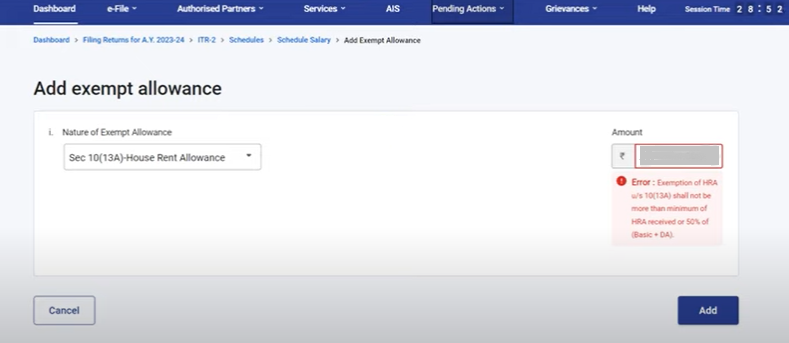

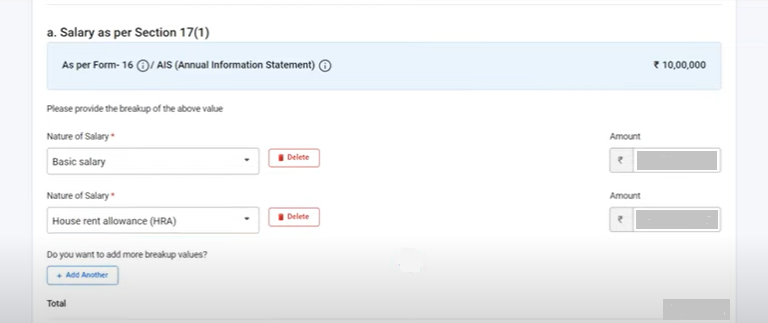

I have 2 form 16 for FY 2021-22 and HRA is mentioned in only 1 form 16. But while filling ITR 2 when I enter the HRA amount calculated for entire FY, it gives error stating "Exemption of HRA shall not be more than HRA received or 50% of basic + da" unlike in ITR1 where only warning occurs. So how do I proceed further? Will it be fine if I show HRA amount in Any Other section of allowances exepmt u/s 10 continue further?

Menu

Error in HRA u/s 10(13A) while filling ITR2 with 2 form 16

Replies (9)

Recent Threads

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

Related Threads

CAclubindia

CAclubindia