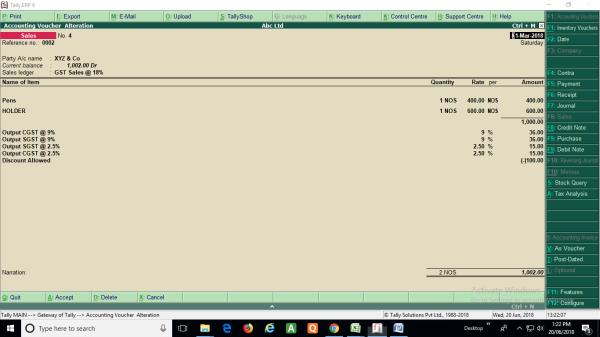

If we have 2 items in the invoice:

'A' taxable @ 5% and 'B' taxable @ 18% and we offer discount to our dealers on total invoice value on not on item basis, then how can we exclude discount while calculating GST while entering the invoice in Tally ERP 9.

CAclubindia

CAclubindia