Hi,

Do anyone know if late fee waiver ended two days early?

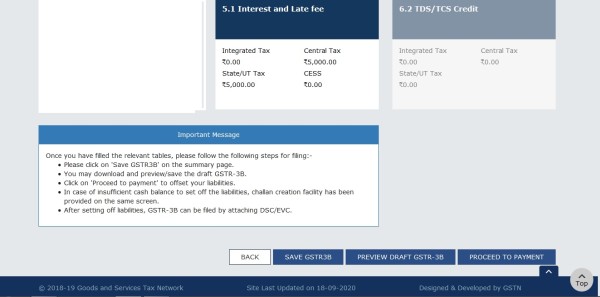

When I went to file, I got late fee of 10,000. 5,000 for CGST and SGST each.

Infosys is not replying at all. do anyone know?

Screenshot taken on 28th i.e. yesterday.

thanks

Hi,

Do anyone know if late fee waiver ended two days early?

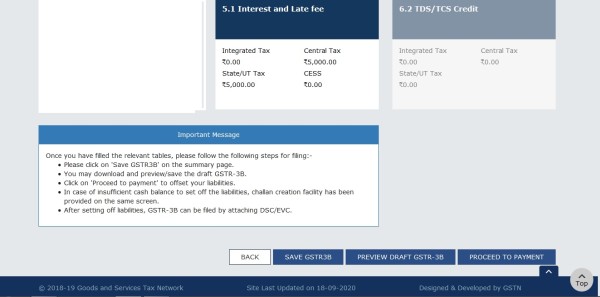

When I went to file, I got late fee of 10,000. 5,000 for CGST and SGST each.

Infosys is not replying at all. do anyone know?

Screenshot taken on 28th i.e. yesterday.

thanks