No, you can file between 1st sep to 5th sep

Menu

Forum Search

Query on GSTR 3B

I have make the payment of CGST & SGST on 23rd Aug, this is not shown in Electronic cash ledger till now, how do i file my 3b retturn with in due date 25th Aug 17.

as the ststus shown as Awaiting Bank Confirmation from past 3 days.

Still you are facing the same problem

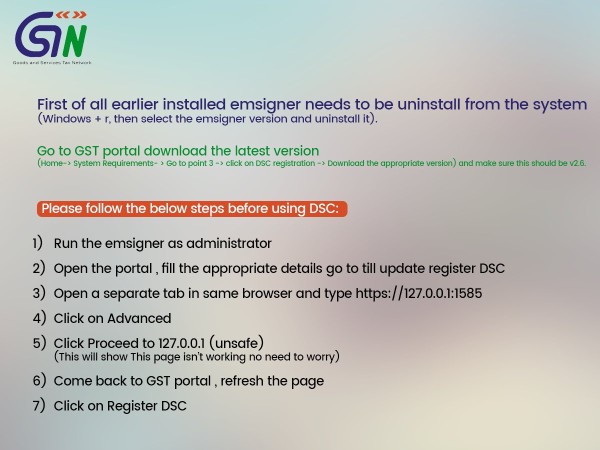

Try this method.....

Please install the new emSigner version v2.6 from the website .Run as Administrator by right clicking on the desktop icon. (Sometimes it is not required.)

Run the emSigner as 'Run As Administrator' mode by right clicking the Desktop icon.

Then login to your GST account in GST portal .

Goto the menu Update / Enroll DSC under 'My profile'.

Click on the menu.

You will enter the DSC Update page.

But DON'T CLICK the Update button.

Open a new tab in your browser. ( But DON'T CLOSE your GST login page on previous tab)

Type the address https://127.0.0.1:1585

You may see some errors and also a button BACK TO SAFETY .

Don't click on that.

Dont Worry ...

Instead click on ADVANCED and click 'Proceed Anyway '.

Then return to your GST login tab with DSC Update/ Enrollment page.

First click 'REFRESH BUTTON' (the CIRCUAL ARROW , very near to the address bar of Chrome.)

Click 'Update' Button for updating / enrol DSC.

Try to enroll your DSC .. It may work. After enrollment go to Sign menu for signing.

Still you are facing the same problem

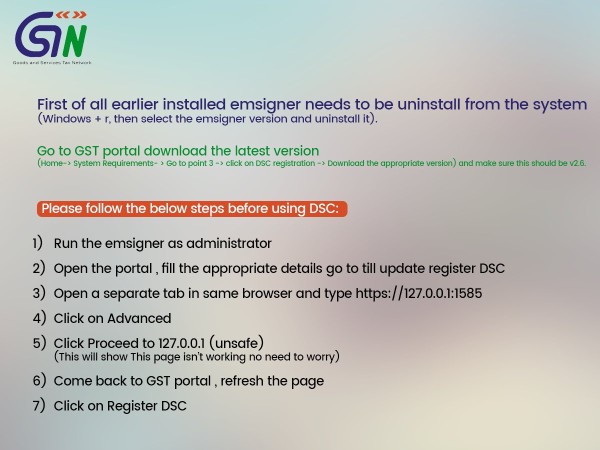

Try this method.....

Please install the new emSigner version v2.6 from the website .Run as Administrator by right clicking on the desktop icon. (Sometimes it is not required.)

Run the emSigner as 'Run As Administrator' mode by right clicking the Desktop icon.

Then login to your GST account in GST portal .

Goto the menu Update / Enroll DSC under 'My profile'.

Click on the menu.

You will enter the DSC Update page.

But DON'T CLICK the Update button.

Open a new tab in your browser. ( But DON'T CLOSE your GST login page on previous tab)

Type the address https://127.0.0.1:1585

You may see some errors and also a button BACK TO SAFETY .

Don't click on that.

Dont Worry ...

Instead click on ADVANCED and click 'Proceed Anyway '.

Then return to your GST login tab with DSC Update/ Enrollment page.

First click 'REFRESH BUTTON' (the CIRCUAL ARROW , very near to the address bar of Chrome.)

Click 'Update' Button for updating / enrol DSC.

Try to enroll your DSC .. It may work. After enrollment go to Sign menu for signing.

Hey Everyone,

There is a case, assess by mistake submitted trans 1 by mistake but not filled.

CAn it be filled and submitted again?

Please suggest the solution

Kindly Suggest the solution

What if Trans1 is submitted(not filed) blank by mistake. Whereas figures was required to be submitted.

Return 3B has been filed before 20th August 17.

Liability raised on filing 3B for July in coloum (3.1) and the liability amount has been paid before submiting 3B but no credit of deposited amount has been gin in cash ledger. in coloum (4) Eligible ITC an input on inward( Purchase under Tax Invoice from Registered GSTin Party) has been wrongly entered in coloum (3) - Inward supply liable to reverse charges( other than 1 & 2 above ) in place of (5) all Other ITC. Since cash ledger showing 0 deposit the liability is not shown as paid and in result Return 3B could not be filed. Screenshot are attached for your perusal. Please advise.

Ashok Srivastava

Hi,

I have filed GSTR-3B return at the time of deadline by taking only itc but after that I realized that I forgot to pay gst liability on a reverse-charge bill, against which we can avail ITC in next month filing, there-after on the very next day I have paid the amount of gst liability.

So please suggest can we able to revise GSTR-3B or if we fill-up GSTR-1 correctly, will we face any issue, if so how to resolve it.

| Originally posted by : Shijoy | ||

|

Still you are facing the same problem Try this method..... Please install the new emSigner version v2.6 from the website .Run as Administrator by right clicking on the desktop icon. (Sometimes it is not required.) Run the emSigner as 'Run As Administrator' mode by right clicking the Desktop icon. Then login to your GST account in GST portal . Goto the menu Update / Enroll DSC under 'My profile'. Click on the menu. You will enter the DSC Update page. But DON'T CLICK the Update button. Open a new tab in your browser. ( But DON'T CLOSE your GST login page on previous tab) Type the address https://127.0.0.1:1585 You may see some errors and also a button BACK TO SAFETY . Don't click on that. Dont Worry ... Instead click on ADVANCED and click 'Proceed Anyway '. Then return to your GST login tab with DSC Update/ Enrollment page. First click 'REFRESH BUTTON' (the CIRCUAL ARROW , very near to the address bar of Chrome.) Click 'Update' Button for updating / enrol DSC. Try to enroll your DSC .. It may work. After enrollment go to Sign menu for signing. |

|

Nice Reply Mr Shijoy

| Originally posted by : Anamika | ||

|

Hey Everyone, There is a case, assess by mistake submitted trans 1 by mistake but not filled. CAn it be filled and submitted again? Please suggest the solution |

|

Once submitted, Then No way for editable....

This is in every forms in GST. Once Submitted then no way for edit/Change/Revise

| Originally posted by : Ashok Srivastava | ||

|

Return 3B has been filed before 20th August 17. Liability raised on filing 3B for July in coloum (3.1) and the liability amount has been paid before submiting 3B but no credit of deposited amount has been gin in cash ledger. in coloum (4) Eligible ITC an input on inward( Purchase under Tax Invoice from Registered GSTin Party) has been wrongly entered in coloum (3) - Inward supply liable to reverse charges( other than 1 & 2 above ) in place of (5) all Other ITC. Since cash ledger showing 0 deposit the liability is not shown as paid and in result Return 3B could not be filed. Screenshot are attached for your perusal. Please advise. Ashok Srivastava |

|

No way....

You can adjust it in GSTR 1 and 2 form. Not adjust/edit/Change in 3B.....

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

- Capital Gains from Cancelled Residential Project

Related Threads

CAclubindia

CAclubindia