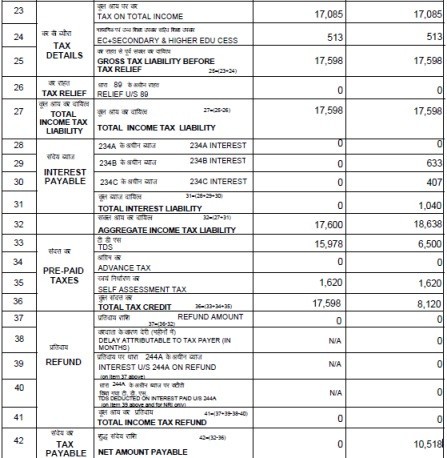

I filed e return for AY 13-14. Yet to get an initmation but logged in today to find that the process is updated to IT processed and Demand Determined.

The amount is too much that anyhow possible.

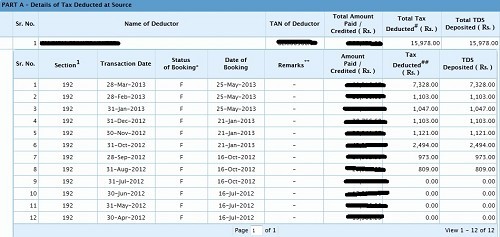

I am a salaried person and that is my main source of income and some other income from FD interest.

I paid self assessment tax at the time of filing return as per my calculation.

I was told by CPC customer care that I will receive the intimation soon.

I have some questions:

- What are my options if I find the demand totally or partially wrong?

- Till when can I pay the remaining tax (if any)?

- What can I do to get this rectified in either of the cases:

I owe some outstanding tax but not the full amount that is determined

I don't owe any further tax amount

This is my third ITR and the first time this kind of thing has happened.

I am currently outside India and will be returning after about 3 months. What are my options. Should I be worried?

Right now I am worried as this is kind of unexpected.

I am yet to get the detailed calculation of the demand. Will that be sent with the intimation?

Plz plz help

CAclubindia

CAclubindia