Menu

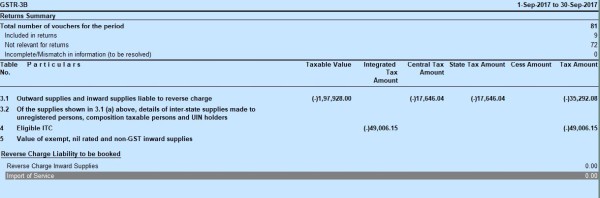

debit note credit note in gstr 3b

how to show debit note against sales invoice in gstr3b to nullify effect of gst on outward supply

Replies (20)

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia