Menu

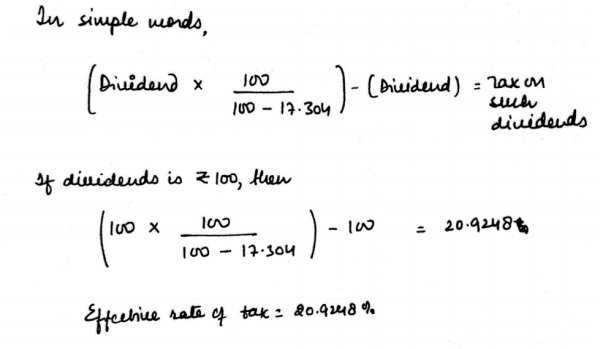

DDT grossing up

Kindly, teach me how to gross up

Replies (3)

Recent Threads

- Change HSN

- TDS ISSUE ( DIFFERENT SECTION )

- Company strike off with loan waiver accounting iss

- Board resolution for authorization for GST

- Invoice related audit

- Gst input credit related

- Updated ITR as missed the dead line

- Change if place of business l

- Purchase from unregistered dealer garments busines

- TDS DEDUCTED BUT NOT PAID BY EMPLOYER

Related Threads

CAclubindia

CAclubindia