Student

1309 Points

Joined January 2009

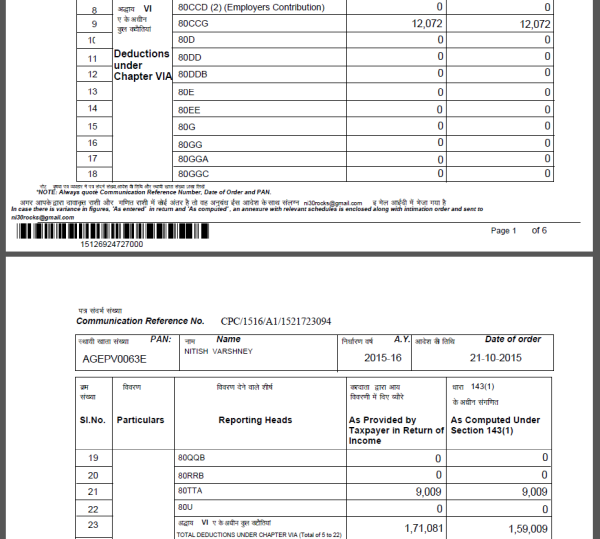

The conditions under section 80 CCG for claiming deduction from Assessment year 2014-15 would be :–

- The gross total income of the assessee for the relevant assessment year should be less than or equal to ₹ 12 lakhs.

- The assessee should be a new retail investor as per the requirement specified under the notified scheme.

- The investment should be in such listed equity shares or listed units of equity-oriented fund specified under the notified scheme.

- The minimum lock in period in respect of such investment should be three years from the date of acquisition .

“New retail investor” means a resident individual,-

(a) who has not opened a demat account and has not made any transactions in the derivative segment before the date of opening of a demat account or the first day of the initial year, whichever is later: Provided that an individual who is not the first account holder of an existing joint demat account shall be deemed to have not opened a demat account for the purposes of this Scheme; or

(b) who has opened a demat account but has not made any transactions in the equity segment or the derivative segment before the date he designates his existing demat account for the purpose of availing the benefit under the Scheme or the first day of the initial year, whichever is later

Hope you have fulfilled the said conditions. If any of the said conditions is not fulfilled then the claim will not be accepted by ITD.

It also can happen that 80ccg exemption failed to be considered. For that you can respond as demand disagree on efiling website and qoute for the reason of not accepting your 80ccg claim

Hope I have cleared your doubt.

CAclubindia

CAclubindia