Menu

Forum Search

Bugs in ITR-2 form Revision PR2 Excel Utility

Nirmal Bhansali

Amarnath Honnavalli

How to report this to Income Tax Department, particularly when last date is fast approaching. Any idea when this is going to get resolved by the department.

Nirmal Bhansali

Nirmal Bhansali ji, I also came across this bug and was searching if anyone came across this issue and reported it. Glad that I cam across your comment, this assures me of the issue. Have you raised grievance on incometaxindia e-filing site? Now that deadline is extended til 30th Aug for tax filing, hopefully they fix this bug soon. If its not fixed then we will have to unnecessary pay 10% tax on the first 1 Lakh amount too. Were you able to find any workaround?

Nirmal Bhansali

Ashish Aggarwal

Hi - I called the ITR helpdesk and explained the issue cited here. They requested to send the details to efilinghelpdesk @ incometax.gov.in

I have just sent an email along with screenshot.

Let's see what solution is provided now.

My suggestion would be that those affected should contact them as well so the helpdesk get sufficiently aware of this and could resolve this quickly.

Amarnath Honnavalli

I had called up Income tax helpdesk regarding Rs.1 lakh, LTCG after threshold limit as per section 112A

I understood that the greyed out cell on this for removing Rs.1 Lack from long term capital gain in CG sheet will be adjusted in SPI_SI sheet. So there is no major issue.

But, there is 1 minor issue, Because this is not adjusted in CG sheet, it will compute the advance tax payable and charged 234C (Interest for deferment of advance tax) in my case. I ignored this because this was small amount

Ashish Aggarwal

UPDATE - Here is the reply received from helpdesk:

"As per the provisions of Income Tax Act, 1961 the exemption of Rs.1,00,000 should be provided while calculating Tax and not for the purpose of computing Income. Therefore for complying with the same in Utility the exemption field of Rs.1,00,000 provided in Schedule CG has been greyed-off(Tag “LessLTCGThresholdLimit” has been removed and the same shall be provided while computing Tax in Schedule SI so that the true intention of law can be complied with."

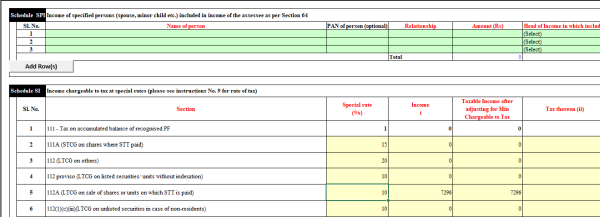

QUERY - I am still unclear how to accommodate this in the ITR2 utility. I have Rs 9601 of STCL from AY 2018-2019 which I have filled in Schedule CFL to carry forward. Then, I have LTCG of Rs 16897 in this year which has been filled in Schedule CG (which should be non-taxable since it is under the threshold limit).

Now the excel utility is setting-off these two figures and remaining Rs 7296 (16897-9601) are being shown as current year’s income remaining after set off. This is incorrect, because I should be able to carry forward the full amount of STCL (Rs 9601) for next year, and no set-off should be done as Rs 1,00,000 of LTCG is tax exempt. Please note - while calculating tax from the utility, the net tax turns out to be correct (it considers exemption in background) - however, the STCL can not be carried forward and unnecessarily getting adjusted i.e. Total loss Carried Forward to future years = Zero

Can someone here provide any suggestion on how to resolve this considering the reply from helpdesk i.e. how to fill this information in Schedule SI ?

Nirmal Bhansali

| Originally posted by : Nirmal Bhansali | ||

|

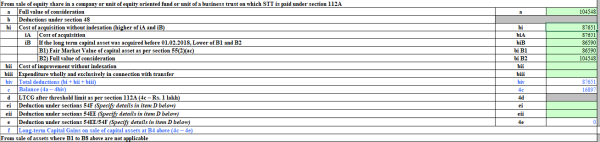

There are definitely few bugs in Schedule CG which need to be fixed before due date. 1. Item b4-d : LTCG after threshold limit as per section 112A(4c-Rs 1 lakh) is disabled. 2. Item b4-f : LTCG on sale of capital assets at B4 above (4c-4e) is wrong and it should have been (4d-4e) 3. Due to above bugs, any positive LTCG <1 lakh or above 1 Lakh is carried forward to other schedules n taxed accordingly without considering threshold limits. 4. These two bugs were not there in earlier revision PR1.2. 5. These bugs need to be fixed immediately to enable taxpayers file ITR before due date. |  |

Dear Sir,

After the recent utility changes, department has shifted the exemption of Rs. 1,00,000 from Schedule CG to Schedule SI.

assume your Capital gain before exemption is Rs. 2,50,000. Then 2,50,000 will be transferred to Schedule SI but tax on such income will be calculated after providing exemption of Rs. 1,00,00.

so final tax will be (2,50,000-1,00,000)*10%=15,000

*Ignoring basic exemption limit.

Ashish Aggarwal

Hi - Two things here:

1) When you say "transferred to Schedule SI" - Do you mean that automatically the Schedule SI cells will get populated, OR do you have to manually enter the data. Can you please show how?

2) Even in that case - what about the issue of STCL getting unnecessarily adjusted. It should be carried forward to next year but current utility adjusts it against the LTCG during "Compute Set-off"

| Originally posted by : rishabhsharma | ||

|

Originally posted by : Nirmal Bhansali There are definitely few bugs in Schedule CG which need to be fixed before due date. 1. Item b4-d : LTCG after threshold limit as per section 112A(4c-Rs 1 lakh) is disabled. 2. Item b4-f : LTCG on sale of capital assets at B4 above (4c-4e) is wrong and it should have been (4d-4e) 3. Due to above bugs, any positive LTCG <1 lakh or above 1 Lakh is carried forward to other schedules n taxed accordingly without considering threshold limits. 4. These two bugs were not there in earlier revision PR1.2. 5. These bugs need to be fixed immediately to enable taxpayers file ITR before due date. Dear Sir, After the recent utility changes, department has shifted the exemption of Rs. 1,00,000 from Schedule CG to Schedule SI. assume your Capital gain before exemption is Rs. 2,50,000. Then 2,50,000 will be transferred to Schedule SI but tax on such income will be calculated after providing exemption of Rs. 1,00,00. so final tax will be (2,50,000-1,00,000)*10%=15,000 *Ignoring basic exemption limit. |

|

| Originally posted by : Ashish Aggarwal | ||

|

Hi - Two things here: 1) When you say "transferred to Schedule SI" - Do you mean that automatically the Schedule SI cells will get populated, OR do you have to manually enter the data. Can you please show how? 2) Even in that case - what about the issue of STCL getting unnecessarily adjusted. It should be carried forward to next year but current utility adjusts it against the LTCG during "Compute Set-off" Originally posted by : rishabhsharma Originally posted by : Nirmal Bhansali There are definitely few bugs in Schedule CG which need to be fixed before due date. 1. Item b4-d : LTCG after threshold limit as per section 112A(4c-Rs 1 lakh) is disabled. 2. Item b4-f : LTCG on sale of capital assets at B4 above (4c-4e) is wrong and it should have been (4d-4e) 3. Due to above bugs, any positive LTCG <1 lakh or above 1 Lakh is carried forward to other schedules n taxed accordingly without considering threshold limits. 4. These two bugs were not there in earlier revision PR1.2. 5. These bugs need to be fixed immediately to enable taxpayers file ITR before due date. Dear Sir, After the recent utility changes, department has shifted the exemption of Rs. 1,00,000 from Schedule CG to Schedule SI. assume your Capital gain before exemption is Rs. 2,50,000. Then 2,50,000 will be transferred to Schedule SI but tax on such income will be calculated after providing exemption of Rs. 1,00,00. so final tax will be (2,50,000-1,00,000)*10%=15,000 *Ignoring basic exemption limit. |

|

1. when you enter data in sr. no. B4 of ITR-2, utility automatically transfers the amount to Schedule SI. you dont have to do anything. All the rows of Scedule SI are disabled so you can not enter any amount manually.

2. Before these changes, setting off of losses was proper. First we used to get Rs. 1,00,000 exemption and then losses set off.

but now first losses are set off against LTCG u/s 112A and balance LTCG, if any, will be eligible for exemption of Rs. 1,00,000.

Ashish Aggarwal

OK. So that means we can't do anything about STCL issue. For the Schedule SI, apart from the adjusted value after set-off - I don't see any mention of Rs 1,00,000 mentioned or auto-populated anywhere. Please see images attached.

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia