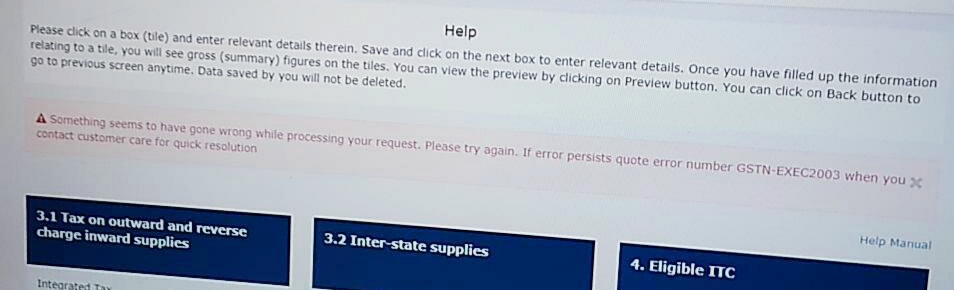

The GSTN-Exec2003 error code typically indicates a problem with either the GSTN portal or the taxpayer's registration when attempting to file their GST return. It may be due to network connectivity issues, technical glitches on the portal, a canceled or pending GST registration, discrepancies between the taxpayer's details and the GSTN data, or incomplete or misfiled returns.

CAclubindia

CAclubindia