Hi Forum.

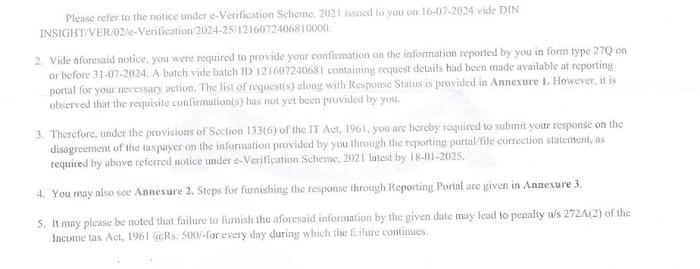

I have received a notice under section 133(6) of IT Act, as attached.

It refers to confirmation of 27Q by me (buyer) and response from seller. However I am not pending any confirmation from my side.

Seller has given same response.

Please can you please assist me in understanding which response is the notice referring to ? And where do we need to provide confirmation (both seller and buyer)

CAclubindia

CAclubindia