About the Course

With the paradigm shift in the Indirect Tax structure with the GST rollout on 01st July 2017. It is really important to understand the new GST in India, new compliances and the changes in processes in operating business

To help professionals and aspirants with the ongoing changes and to make them GST experts CAclubindia has introduced Topic Wise short courses on GST.

This will help the participants in getting a grasp over the important aspects of GST along with the practical case studies and examples for a better understanding of the respective topics.

Place of supply of goods under GST defines whether the transaction will be counted as intrastate or interstate, and accordingly levy of SGST, CGST & IGST will be determined.Time of Supply and Place of Supply determines when and where a particular good or service has to be taxed.The 2 hours session on Place of Supply will cover the respective sections and provisions with detailed explanations and illustrations.

Course Content :

- Intra- State vs. Inter- State Supplies

- Place of Supply for Goods

- Place of Supply for Services

- Place of Supply for Export and Import of Services

Who is this course for?

- Any young practitioner looking to add a few new skills to their existing practice

- CAs in practice who wish to diversify their practice into advanced level areas of GST

- CA/CS Students and fresher CAs/CS who wish to learn advanced level concepts of GST

- Accounts, BCOM, MCOM graduates already being well versed with GST and keen on learning the advanced level concepts in depth

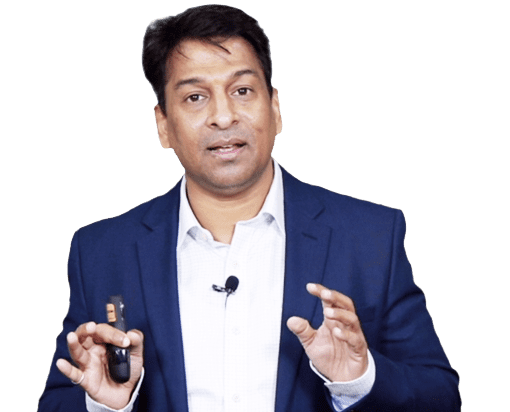

CA Bimal Jain ,

Bimal Jain, He is a Member of Institute of Chartered Accountants of India since May 1994 and Member of Institute of Company Secretaries of India since December 2006 along with a Bachelor’s degree in Law.

He has more than 24 years of experience in Indirect Taxation and specializes in all aspects of Service Tax, Value Added Tax (VAT)/ Central Sales Tax (CST), Central Excise, Customs, Foreign Trade Policy (FTP), Special Economic Zone (SEZ), Export Oriented Unit (EOU), Export-Import Laws and well acquainted with the concept and impact of Goods and Services tax (GST).

He has blend of Industry and Consulting experience in renowned Companies viz. LG Electronics India Pvt. Ltd, Honda Motorcycle Scooters India Pvt. Ltd, Hindustan Development Corporation Ltd, Khaitan & Company and presently he is the Executive Director of A2Z Taxcorp LLP – a boutique Indirect Tax firm.

Significant Transactions:

- He has hands-on experience in providing opinion & advisory services, carrying out diagnostic review of business operations, process review, structuring of business model, undertaking litigation services at all appropriate forum including High Court, CESTAT, representation before the TRU/ CBEC/ DGFT, etc. for various matters concerning to trade, industry and commerce

- He is also a writer of 5 editions of GST book.

Professional Membership:

- Mentor of Indirect Tax Committee of PHD Chamber of Commerce

- Chairman of the Corporate Advisory Committee of IPEM Group of Institutions

- Member of Indirect Tax Committee of ASSOCHAM/ FICCI

- Special invitee of Indirect Tax Committee of ICAI/ ICSI

- Member of eminent faculties in Indirect Tax Committee of ICAI/ ICSI/ ICMA

Awards & Recognitions:

- Keynote Speaker at Guinness World Record made by ICSI in “Largest Taxation Lesson” on GST, attended by 4500+ Participants, breaking the earlier record of Japan

- Business Leader Award from Amity School, Noida

- Best Speaker Award from NIRC- ICAI/ ICWAI

- Young Achievers Award at Igniting Minds, 2015

- Best Participant Award in MSOP- 117th Batch by ICSI.

- Total Length of Videos: 137.47 minutes / 2.30 hours (approximately)

- Expiry: 2 months with 2 times viewing whichever is earlier from the date of registration.

- Videos are meant for web viewing only and cannot be downloaded. Videos are available in Full Screen viewing

- Course/Subject purchased once cannot be cancelled.

Buy now