Friends,

Click here to download one excel file (in zip format) to compute TDS from Salary of Employees with tax computation for F.Y. 2011-12 works in Excel-2007( service pack 2) only.

See three sheets as under:

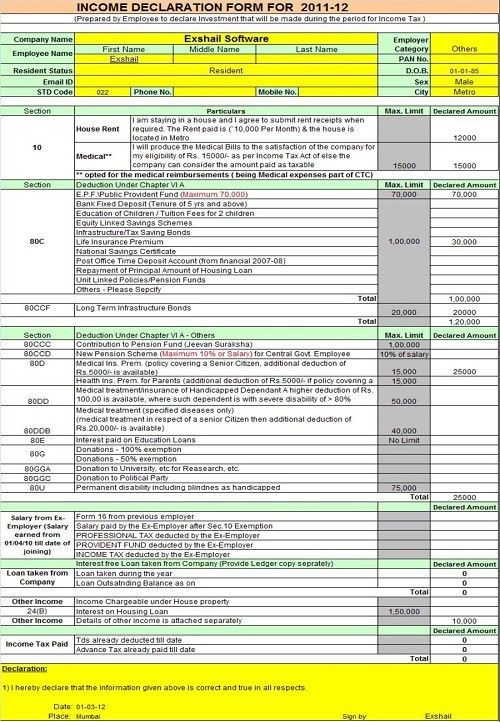

1. Declaration form by Employee.

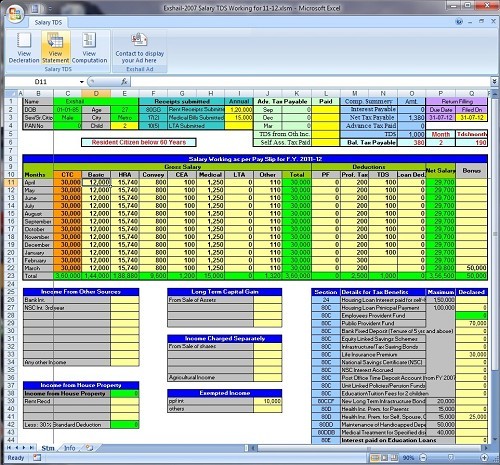

2. Salary Statement sheet from Payslip.

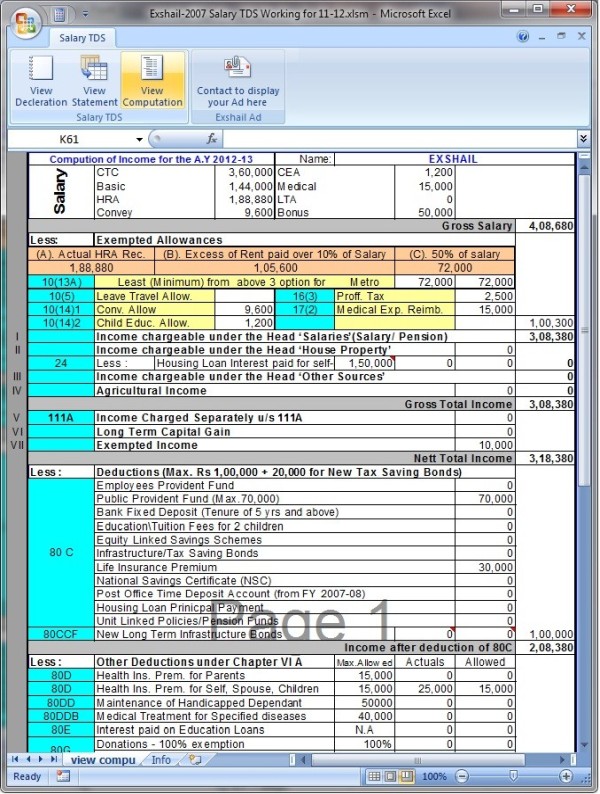

3. Tax Computation.

Fill declaration form received from Employee, Fill 2nd sheet for salary working from payslip & other details in yallow highlited cells.You can enter remaining month to know tds per month to deduct from salary.

It also caculate interest u/s 234 A B C

When you open file select enable macro to work this file.

If anyone have problem opening this file in excel-2007, report here with screenshoot.

Exshail

CAclubindia

CAclubindia