Dear Sir,

A company is getting imported certain goods @ 18% IGST along with custom duty and its customers mainly include research organizations for whom GST payable is @ 5% GST(since research organizations receive exemption). is it eligible to claim refund ITC under RCM?Any circular or notification

plz update sir..

Menu

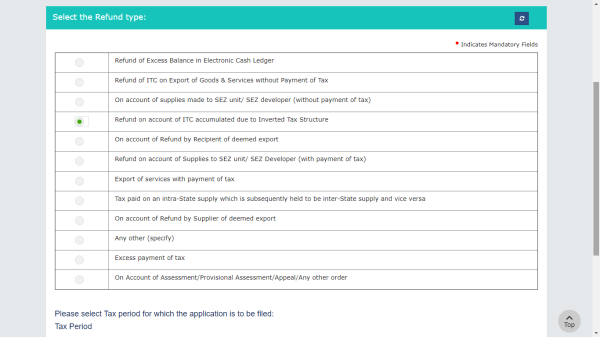

Refund on inverted duty structure

Replies (7)

Recent Threads

- TDS DEDUCTED BUT NOT PAID BY EMPLOYER

- GST RCM GTA

- TDS Challan interst amount wrongly paid as surchar

- Query on TDS & Stamp Duty

- Query on form 26QB and TDS deduction

- Received this confusing IT notice. How to reply

- Houston Sign Company For Custom Signs, Banners &am

- Refund due to change in GST Rate Tobacco Products

- Lease related query can we rent out lease ?

- Planning of Ceased a Business i.e Closure of Compa

Related Threads

CAclubindia

CAclubindia