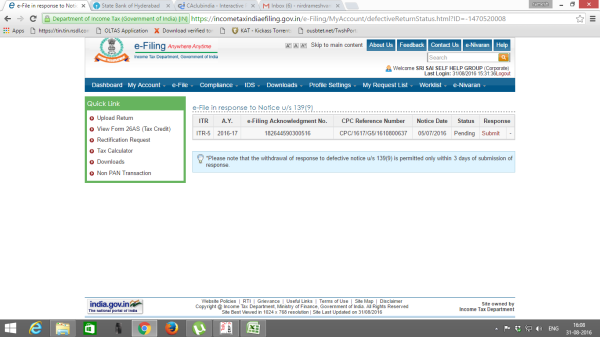

we are runing SELF HELP GROUPS since last 10 years,every year we are filing ITR-5 and we receive the refund amoount also,but this year i.e AY-2016-17, I have filed the same returns but this receive the notice u/s.139(9)

E-file in response to notice u/s 139(9)

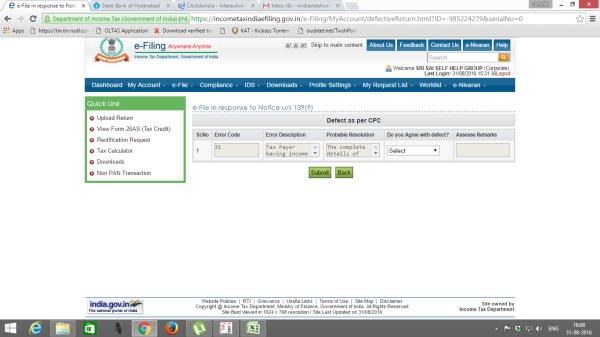

Error code:- 31

Error descrition:- Tax Payer having income under the head “Profits and gains of Business or Profession” but not filled Balance Sheet and Profit and Loss Account

Probable resolution:- The complete details of Profit and loss account and Balance Sheet should be entered in the return.

please kind resolve my problem.and tell me the procedure of recitification of error.

please kind see the Sceen Shots

CAclubindia

CAclubindia