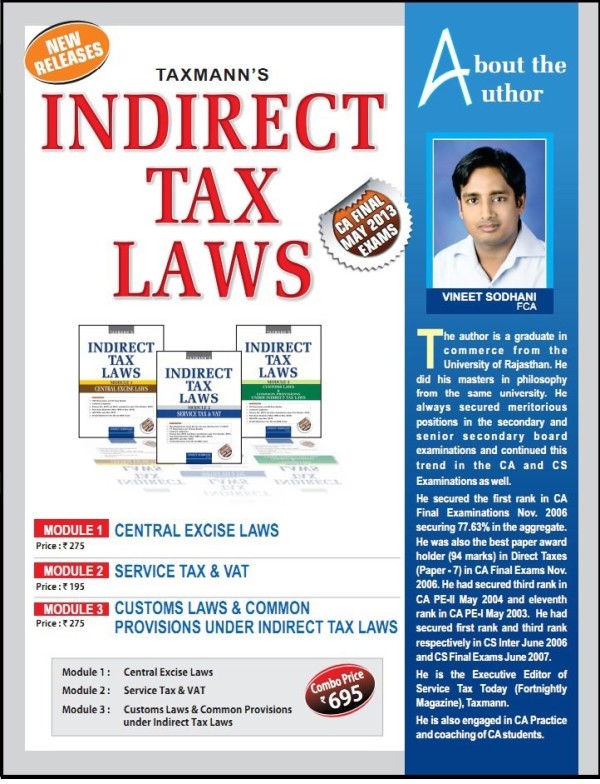

CA Vineet Sodhani, who used to write the book with the Bangar's for Indirect Taxation of CA Final has come up with a new book of his own in 3 separate modules, published by Tax Mann

Indirect Tax Laws - (Set of 3 Modules)

|

Price : INR 695 | USD 50 |

ISBN No.:978-93-5071-137-8 |

|

Edition : 1st Edition 2013 |

Weight : 1360 gms |

|

Author : Vineet Sodhani |

|

Module I - Central Excise Laws

An examination oriented Module on Central Exciseconceived especially for students of CA Final

> The entire subject is presented in Notes format

> Written in simple, lucid and succinct manner, avoiding legal jargons

> Use of Charts and Tables for easy understanding

> Attractive and Catchy presentation

> Covers 109 Illustrations and 97 Case Studies

> Case Studies solved in Unique “Law-Question-Analysis-Conclusion (LQAC)” format

> Coverage of Landmark Judgments with short digest for quick revision

> Coverage of Finance Act, 2012 and other amendments upto 31st October, 2012

> Incorporates Past Examination Questions (May 1996 to Nov. 2012) (Topic/ Section-wise)

> Coverage of theoretical questions asked for in Past Examinations (para-wise)

> Incorporates graded questions from ICAI RTPs upto Nov., 2012, CS and CMA exams

Module II - Service Tax & VAT

An examination oriented Module on Service Tax & VATconceived especially for Students of CA Final

> The entire subject is presented in Notes format

> Written in simple, lucid and succinct manner, avoiding legal jargons

> Use of Charts and Tables for easy understanding

> Attractive and Catchy presentation

> Covers 77 Illustrations and 12 Case Studies

> New and Unique Illustrations on New Service Tax Law

> Coverage of Landmark Judgments with short digest for quick revision

> Coverage of Finance Act, 2012 and Other amendments upto 31st October, 2012

> Incorporates Past Examination Questions (May 1996 to Nov., 2012) (Topic/ Section-wise)

> Coverage of theoretical questions asked for in Past Examinations (para-wise)

> Incorporates graded questions from ICAI RTPs upto Nov. 2012, CS and CMA exams

Module III - Customs Laws and Common Provisions Under Indirect Tax Laws

An examination oriented Module on Customs Laws and Common Provisions under Indirect Tax Laws conceived especially for Students of CA Final

> The entire subject is presented in Notes format

> Written in simple, lucid and succinct manner, avoiding legal jargons

> Use of Charts and Tables for easy understanding

> Attractive and Catchy presentation

> Covers 33 Illustrations and 88 Case Studies

> Coverage of Landmark Judgments with short digest for quick revision

> Coverage of Finance Act, 2012 and Other amendments upto 31st October, 2012

> Incorporates Past Examination Questions (May 1996 to Nov. 2012) (Topic/ Section-wise)

> Coverage of theoretical questions asked for in Past Examinations (para-wise)

> Incorporates graded questions from ICAI RTPs upto Nov. 2012, CS and CMA exams

CAclubindia

CAclubindia