Issue: After filling loss data into ITR4 application it is still showing taxable income amount 9001/-

In the fiscal year 2012-13 I had a loss of 267600/- and and had lost my complete margin money and my demat account had final debit of 267600/- into commodities trading. I do not have any other income that year.

I filed my ITR with ITR4 excel (2012_ITR4_PR11.xlsx) downloaded from ITD official website as per instructions.

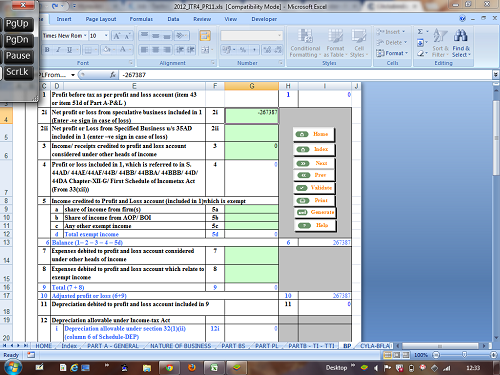

I filled my basic details in "PART A - GENERAL" sheet. Than I filled only my loss amount of -267387 in 2i section of "BP" sheet.

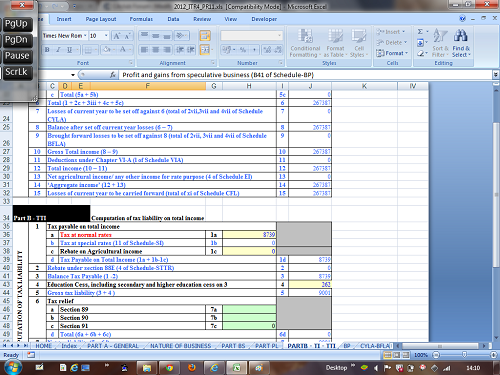

Than I checked "PARTB - TI - TTI" sheet in which its showing tax payable amount is 9001/-.

I rcvd a mail this week and asked to pay 9500/- tax withing 30 days.

What possible mistake I am doing and how can I claim my loss of 267600/- to be carry forwarded to next year. OR

Do I need to pay tax on loosing money which I have actually borrowed from my mother?

I want to generate correct xml data and want to resubmit my ITR. All I need help with the calculation part.

Thanks for reading my post and your valued help!

CAclubindia

CAclubindia