Hi

My wife filed her ITR for AY 2017-18 in time with proper declaration under different heads thru her CA.

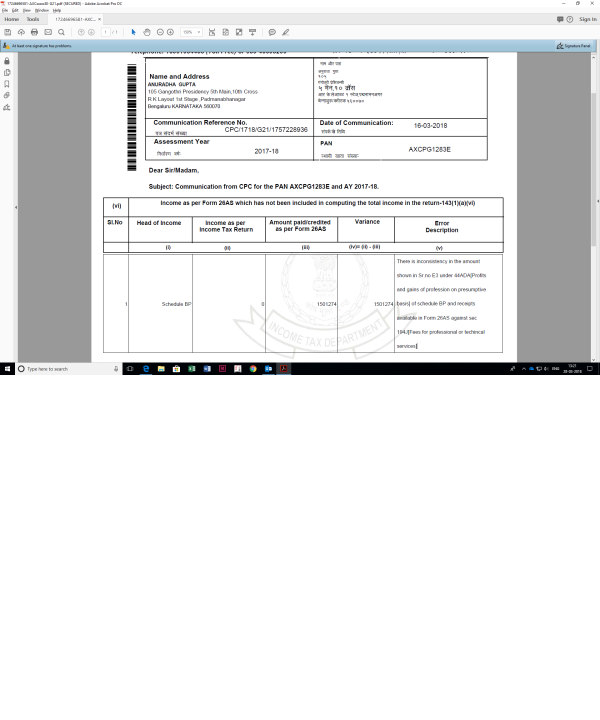

Two days back, received an E-Proceeding Intimatioon under Section 143(1)(a) in which it is mentioned that Income declaraed as per Return is ZERO whereas in the uploaded XML, and resultant PDFs and Acknowledgement, it is clearly shown the total Income from Business and other sources.

Also tried reaching CPC at 18001034455 and 080-46605200 but getting message that numbers can't be reached due to technical issues.

Can I get a proper guidance on how to proceed.

CAclubindia

CAclubindia