Service

2728 Points

Joined April 2008

What is LBT?

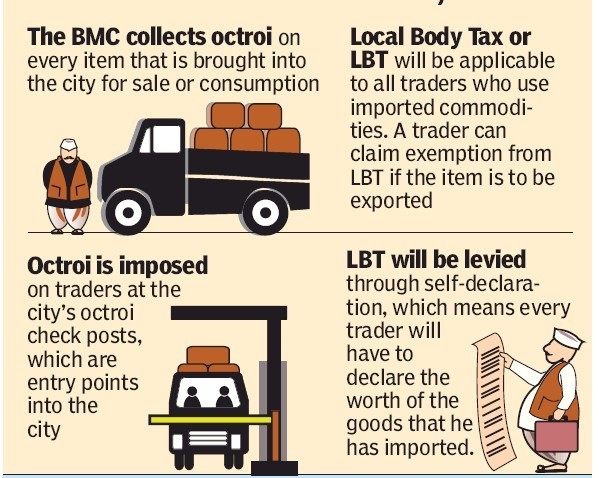

LBT , Local Body Tax is the tax on entry of goods for use / consumption within areas of the local civic bodies. It is a self assessment or account based method of paying local tax, where the businessmen or trader himself declares his tax liability. Unlike in the octroi regime, trucks carrying goods will not be subjected to physical checking at the check post

It works differently from the octroi system. Traders have to compile a list of all goods procured within the month, feed the matter into the software provided by the civic body to check their LBT liability. They have to make payment once every 40 days using online portals, cheque, demand draft or cash through a designated bank or counters of the civic bodies.