Dear Experts,

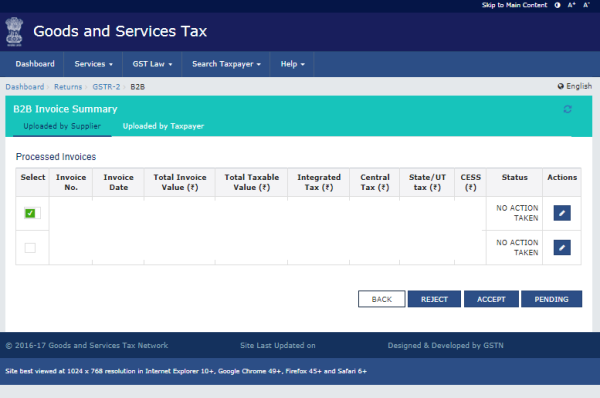

1. In the above if the input credit not eligible for us what we will need to do it? If the input credit is related to our business we can accept it.

2. What are the proceedure to file GSTR 2? Do we need to don load the returns from GSTR 2A and then need to upload the same in GSTR 2?

CAclubindia

CAclubindia