Dear Team,

EXPORT OF SERVICES

I am from a proprietorship Firm and we provide software development and support services. We have some customers outside India.

In pre-GST regime, we were raising invoices to our customers (outside India) without charging Service Tax we were not paying Service Tax for the same as these are Export Services are exempted.

We are getting payment in foreign currency.

In post-GST regime, Can we do the same practice or we need to charge GST on invoices or Pay GST under reverse charge for these invoices.

In GSTR-1 -> 6A - Exports Invoices

Invoice No. * : <I can fill>

Invoice Date * : <I can fill>

Port Code : <needs not to fill as we are exporting services not goods>

Shipping Bill No. /Bill of Export No. : <needs not to fill as we are exporting services not goods>

Shipping Bill Date/Bill of Export Date : <needs not to fill as we are exporting services not goods>Total Invoice Value * : <I can fill>

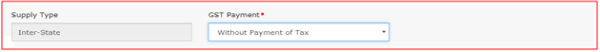

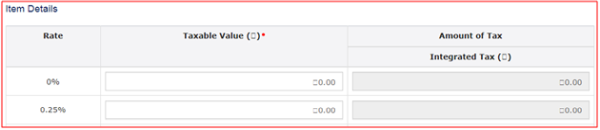

Supply Type: Inter-State (Default)

GST Payment: Do we need to select without payment of Tax?

- With Payment of Tax

- Without Payment of Tax

“As per the IGST Act, export and import of goods and services are deemed to be a supply in the course of inter-state trade or commerce. Exports have been defined under “zero rated supply” meaning that tax rate on the export of goods and services will be zero. While one section is categorizing exports rate at zero, another section 3(5) states that transaction of export will be subjected to IGST, which is even zero rated supplies of services are subject to IGST”

As per the above paragraph, export of goods and services are “zero rated supply” then no GST should be levy on export of service which we are providing.

In layman language, please brief me about the following terms.

- Letter of Undertaking

- Bond

These above mentioned documents are for refund of GST only.

We have issued export invoice on 28-Sep-2017 and we have not charges any GST on this invoice, and also we have not filled Letter of Undertaking/ Bond. If these are mandatory prior to export of services then what should I do now?

In GSTR-1 13 - Documents Issued

Receipt Voucher

- Is this receipt voucher is for only of advance receipt?

- Do we need to maintain receipt vouchers for our normal receipt against GST invoices?

Payment Voucher

- Is this payment voucher of advance payment made to vendor?

- Do I need to maintain payment voucher for all the other normal payments? if that is case do we need to maintain separate payment voucher series for non-GST invoice payment and GST invoice payment? If we need not to maintain separate payment voucher series then how will we show payment it in GSTR1 for both GST and non-GST payment in single series?

GST under Section 44ADA of IT

Q: If any person filling his ITR under Section 44ADA and gross receipt not exceeding 50 lakhs in a financial year. He is claiming 50% as presumptive income and paying tax on it without maintaining his books of accounts. Now after GST, can he claim input of GST on expenses he incurred for business purpose and can file his return under Section 44ADA? Or he should not claim GST input credit because he is not maintaining his books of accounts?

CAclubindia

CAclubindia