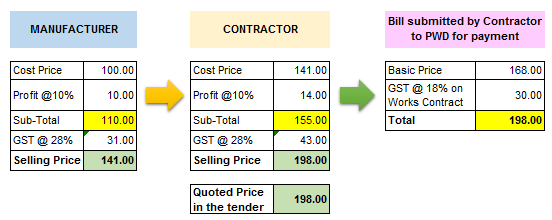

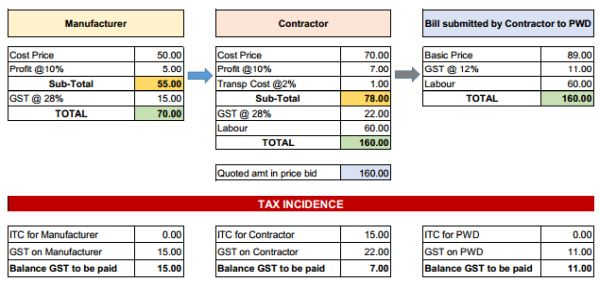

Each item in civil work for construction involves cement, sand, steel etc. has different GST rates. The work is proposed to be executed under Works Contract mode by inviting public tender.

What is the methodology for applying GST to the estimated cost? Should GST be considered for individual items, as each item consists of material and labour, or should GST be added to the total amount for arriving at the total amount put to tender?

CAclubindia

CAclubindia