It is not clear what needs to be entered in each of these fields. For purchasing an apartment, I have redeemed my investments (long term) in batches (May 2022, Nov 2022). The transaction of the apartment started in Oct 22 and apartment was registered in April 2023. In March 2023, I have moved money (apart from token) to the CGAS account and used it in April 23 for balance payments (+prepaying loan in June 23).

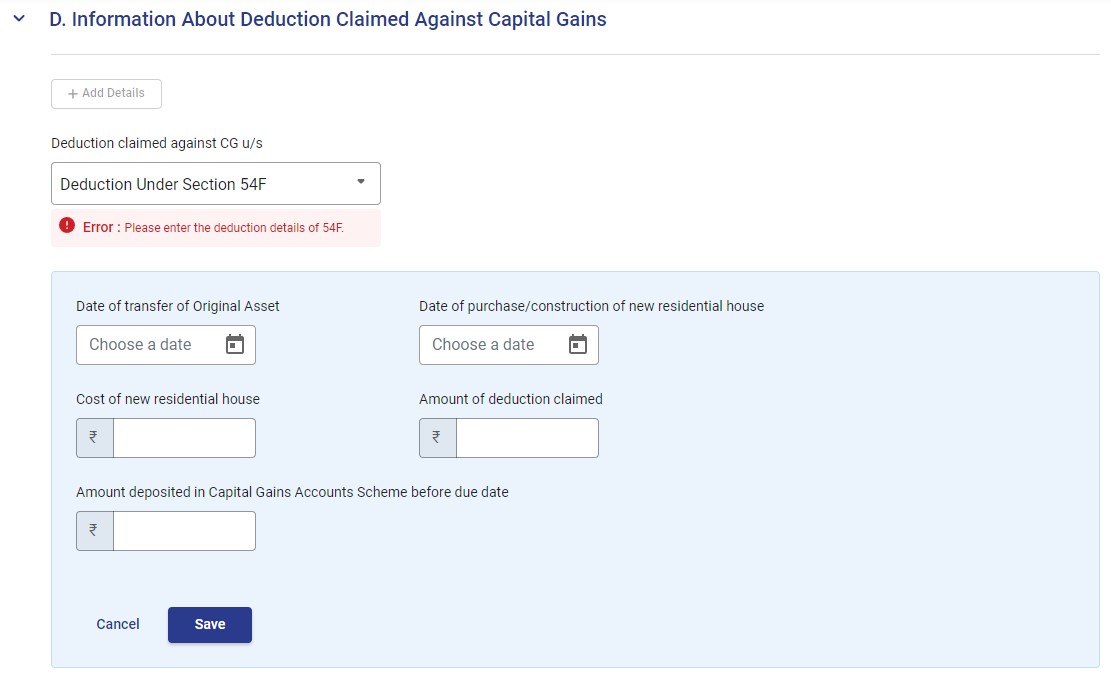

But the below fields are not clear:

1. Date of Transfer of Original Asset: I have multiple dates, so do I have to enter each sell date?

ERROR: When I fill up first redemption date I get an error: Error :If date field is entered then either of ii and iii or iv should be filed. What is this ii and iii or iv?

2. Date of Purchase/Construction of new residential house: Apartment buying started in Oct 22 and ended in Apr 23. So which date I have to provide.

3. Cost of new residential house (understand this is the ultimate cost + registration fees/stamp duty?)

4. Amount deduction claimed: What do I have to provide here, the LTCG deduction claimed or the actual amount redeemed in point 1?

ERROR: error :deduction u/s. 54f claimed here (table d) should match with total of deduction(is) claimed in respective asset. Which value it should match with?

5. Amount deposited in Capital Gain Account Scheme before due date: I deposited all except the token paid in Oct as it was utilized already.

Please can someone help in this.

Attached File : 3884232 20230614191722 table d 54f.jpg downloaded: 154 times

CAclubindia

CAclubindia