can exemption under section 54 & section 54GB both can be avail in a single gain transaction?

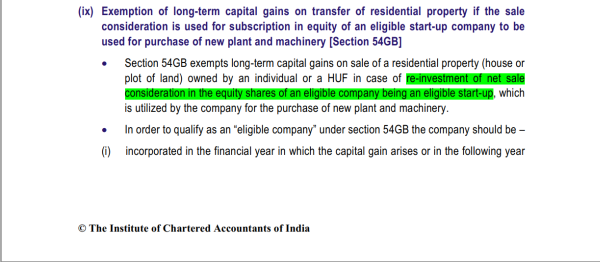

i have asked this earlier and there is mixed answer but majority of expert here say yes do, but in the ICAI text book it say different, under section 54GB exemption is available when net consideration is used in buying share of a new company and then that fund is used is buying new plant & machinery.

here i have attach a image fromthe text book and highlight it also

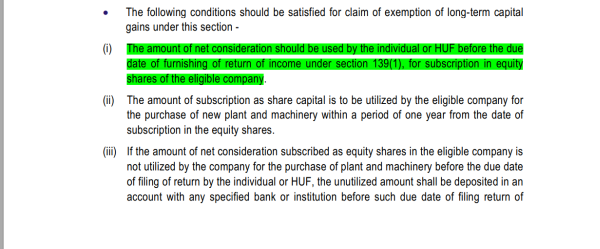

if net sale proceed has to used to avail exemption under section 54gb how can one avail the exemption under 54 and 54 gb in a single LTCG gain.

if net sale proceed has to used to avail exemption under section 54gb how can one avail the exemption under 54 and 54 gb in a single LTCG gain.

CAclubindia

CAclubindia