Menu

Doubt regarding defective return

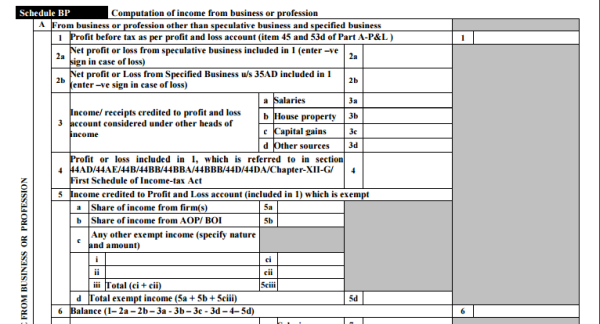

A notice u/s 139(9) came for defective return stating an error code of 810, i.e. Amount credited to P&L a/c have been reduced in Schedule BP Stating they have been consider under Income from salary,Other sources,Exempt Income. But we have Properly debited/shown under respective heads.Still a notice came under Error Code 810.Is there any correction to be made w.r.t this Defective Return?

Replies (4)

Recent Threads

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

- GST RATE OF OUT DOOR CATERING

- Non resident taxation & income tax in India

- GST Rate for oral Hygiene Combo Pack

- GST registration - Address error

- TDS on property pu

- Import of goods IMS action related

- Incometax Survey - Updated Return Filing after the

- TCS under 206C(1F)

Related Threads

CAclubindia

CAclubindia