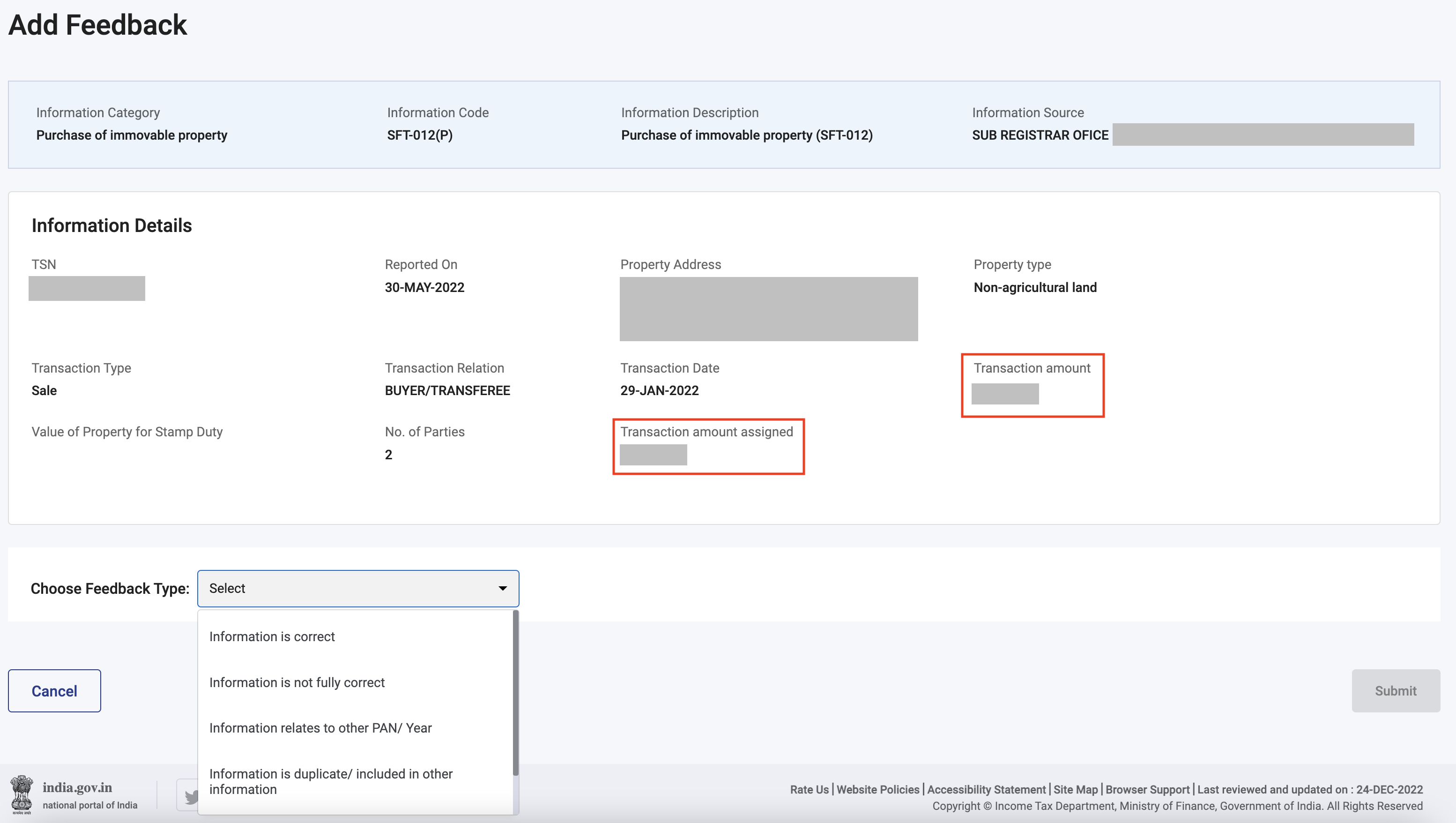

What is difference between "Transaction amount" and "Transaction amount assigned" for "Purchase of immovable property" item under SFT transaction tab (in AIS Feedback of compliance portal).

I was completing AIS feedback for my father on IT compliance portal as he got SMS from IT Dept. He and myself have jointly purchased a property this year which was showing under SFT transaction tab for "Purchase of immovable property" item. On opening this item, it has one of the fields as "Transaction amount assigned" which I don't understand. This field value is equal to property value in "Transaction amount" field. Is this correct? Or is it actual initial amount paid by taxpayer as down-payment (which is less than total cost of property as rest is loan). Do I need to correct its value to actual amount paid before loan? Please assist. (screenshot attached)

CAclubindia

CAclubindia