Mutual Fund Charges

We all know that investing in equities through mutual funds is a great option for an individual as mutual funds not only employ professional management but also have experience of investing in equities and are a safer and better bet as compared to directly investing in equities which have an inherent risk element attached with them.

A mutual fund employs highly qualified management, keeps a regular tab on the stock markets, buys and sells equities on our behalf and does everything to ensure that our money is put to best use while ensuring its safety. But what do mutual funds get in return for these services, in other words – how do mutual funds earn?

Many people have this feeling that it doesn’t matter how mutual funds earn till the time our money is growing in mutual funds. But the fact of the matter is that these mutual funds earn through your money only and mutual fund charges are an important factor while deciding whether to invest or not to invest in a specific mutual fund.

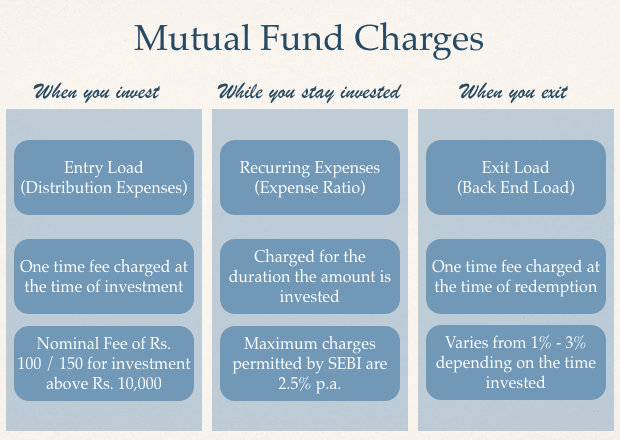

Let’s first have a look at the types of fees charged by mutual funds and then I’ll summarize the impact of these charges.

Types of Charges

There are 3 types of fees which are charged by the mutual funds and these are explained below:

- Entry Load

- Exit Load

- Recurring Charges

ENTRY LOAD – DISTRIBUTION EXPENSE

As the name suggests, this fees is charged by mutual funds at the time of investing in the mutual funds. However, this fee does not go into the pockets of the Asset Management Company and is rather paid as distribution fee to the mutual fund agent through which the investor has applied for subscripttion.

Prior to August 2009, different funds used to pay different amounts as commission to the agent which could sometimes be as high as 2.5% as well. However, in Aug. 2009 SEBI abolished any entry load to be collected by AMC’s to be paid to agents but this didn’t go well within the industry as agents who usually do a lot of marketing and selling on behalf of the company weren’t compensated for their services as a result of which they were not actively working and promoting mutual funds.

Several representations were made by AMC’s in the year 2010 and 2011 to allow them to collect Entry Load as the whole industry was suffering because of this norm and finally in August 2011, SEBI allowed AMC’s to collect Entry Load but limited this fee to a very nominal amount. The maximum fee permissible to be collected as entry load by AMC’s wef August 2011 is as follows

| Particulars | Investment Amount | Commission Payable |

| First Time Investor | Less than Rs. 10,000 | Nil |

| More than Rs. 10,000 | Rs. 150 | |

| Existing Investor | Less than Rs. 10,000 | Nil |

| More than Rs. 10,000 | Rs. 100 |

In case of Systematic Investment Plan (SIP), where the total commitment towards the SIP is more than Rs. 10,000, a transaction charge of Rs. 100 will be levied payable in 4 equal installments starting from the 2nd to the 5th installment.

Points to be noted with respect to Entry Load

- This entry load is payable only in case the investment is made through an agent. In case of direct application being received by the AMC, no entry load is to be collected.

- This fee has to be properly reported in the mutual fund statement. For e.g. – If you are a first time investor and have made an investment of Rs. 20,000, you would be liable to pay Rs. 150 as entry load and your statement should report all these facts as:

- Gross Investment 20,000

- (Less) Entry Load __150

- Net Investment 19,850

As the Net Investment received by an AMC is only Rs. 19850, you would be allocated Mutual Fund units for this amount only and not for the whole Rs.20,000

- Although these charges are collected by the AMC but are payable to the mutual fund agent and you are not liable to pay any other charges to the Mutual Fund Agents.

RECURRING CHARGES – EXPENSE RATIO

Recurring Charges are the charges which are collected by the AMC for professional portfolio management services provided to the investors. An AMC employs highly experienced and qualified staff whose prime concern is to take care of your investments and for providing such services the AMC collects fees which is also referred to as Expense Ratio.

There are a number of expenses which are incurred by AMC’s which have been mentioned below:

| 1. Fund Management Fees | At the discretion of the AMC subject toSEBI Guidelines |

| 2. Marketing/ Selling Expense | |

| 3.Audit Fees | Based on Actual Expense |

| 4.Registrar Fees | |

| 5.Trustee Fees | |

| 6.Custodian Fees |

Over and above these above stated expenses which are incurred on an annual Basis, AMC’s also incur expense at the time of New Fund Offer. To encourage individuals to invest in a mutual fund, an AMC incurs many onetime marketing expenses at the time of launch of the mutual fund. SEBI has prescribed a maximum ceiling on such expense being 6% of the total net assets and these expenses are amortized over a period of 5 years.

However, SEBI has prescribed the maximum expense that may be charged by the AMC and they are based on the Average Weekly Net Assets of the AMC:-

| Average Weekly Net Assets |

Percentage Limit |

|

|

Equity Scheme |

Debt Scheme |

|

| First Rs. 100 Crore |

2.50% |

2.25% |

| Next Rs. 300 Crore |

2.25% |

2.00% |

| Next Rs. 300 Crore |

2.00% |

1.75% |

| On the Balance Assets |

1.75% |

1.50% |

Assuming that an equity scheme generating 15% returns has net assets of Rs 100 crore, with the operating expense ratio at 2.50%, the effective return would be 12.5% (i.e. 15-2.5). Operating expenses are calculated on an annualized basis and are normally accrued on a daily basis and the NAV so computed is shown after deducting these Recurring Expenses.

EXIT LOAD

These are the charges which are liable to be paid in case an investor exits a fund before a specified time frame.

Mutual Funds have a long term horizon and invest with a long term view. However, if a large number of redemption is applied for within a short period of making the investment, it spoils the total corpus available with the mutual funds as a result of which they may have to make necessary changes to the whole portfolio.

To discourage investors from withdrawing funds within a short period, almost all mutual funds charge exit load of 1-3% based on the time within which an application for redemption is filed. They are usually in brackets of 6 months, 1 year etc. and the lower the time frame – the higher would be the exit load. There is no standard exit load fees charged by these AMC’s and it varies from scheme to scheme and is disclosed in the prospectus of every scheme.

Exit Load is also referred to as Back-End Load and the maximum fees that can be charged by Mutual Funds for premature withdrawal is 7%. However, most Mutual Funds charge exit load in the range of 1-3% depending on the time duration for which the funds were invested.

Mutual Fund Fees as a Deciding Factor

From this discussion it is clear that mutual funds charge recurring fees based on its asset base with the charges getting decreased as the fund corpus increases. Thus as the asset size increases, the expenses charge also decrease which would directly impact the NAV of a mutual fund scheme.

Please note that these are the maximum expense ratios permitted by SEBI and the actual may be a bit lower.

Although these charges keep changing from year to year, note that a difference of 1% expense ratio between 2 funds may turn out to be a difference of 10-15% over a period of 10 years. Moreover, it is also highly advisable to keep an eye on the exit load charged by these AMC’s while comparing two funds as different funds charge different exit loads.

post by CA Karan Batra, Accounting and Tax Consultant based in New Delhi.

CAclubindia

CAclubindia