Tax Consultation (US and India)

2970 Points

Joined September 2011

Although, the Income-tax Act,1961 is silent in this regards we must consider the scheme.

Since you are a practising Chartered Accountant, am going into a little depth.

The memorandum to the Finance Act 2016, reads as-

With a view to incentivise affordable housing sector as a part of larger objective of 'Housing for All', it is proposed to amend the Income-tax Act so as to provide for hundred per cent deduction of the profits of an assessee developing and building affordable housing projects if the housing project is approved by the competent authority before the 31st March, 2019 subject to certain conditions which inter alia, include:..

While the Pradhan Mantri Awas Yojana is clear about its goals – affordable housing for all by 2022, it does ensure that the benefits of the scheme are enjoyed by women, economically backward groups of Indian society and the Scheduled Castes and Scheduled Tribes. In an unprecedented move, the government has decided to protect the interests of neglected groups in the country. Transgender and widows, members of the lower income groups and urban poor, and the Scheduled Castes and Scheduled Tribes shall be granted preference when they try to avail the affordable housing scheme. Apart from these groups members of society who often find themselves out of a home, seniors and differently-abled people shall also gain preference in allotment of houses. They shall also be able to choose a ground-floor house if need be. Apart from this, it is also mandatory that while registering to avail the benefits of the scheme, the beneficiaries must necessarily mention their mother or wife’s name. According to news reports, these details were revealed by a Housing and Urban Poverty Alleviation Ministry official before the launch of the scheme.

[Well, only a natural person (an individual can have a mother or wife), so basically the answer is complete here itself, but lets go into more details.]

Now coming to the housing for all scheme. The objectives of the same scheme reads as

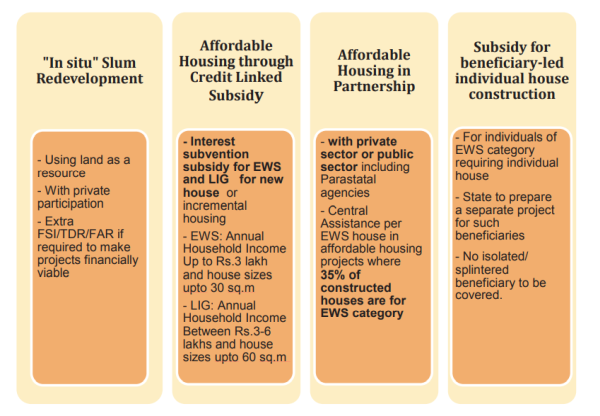

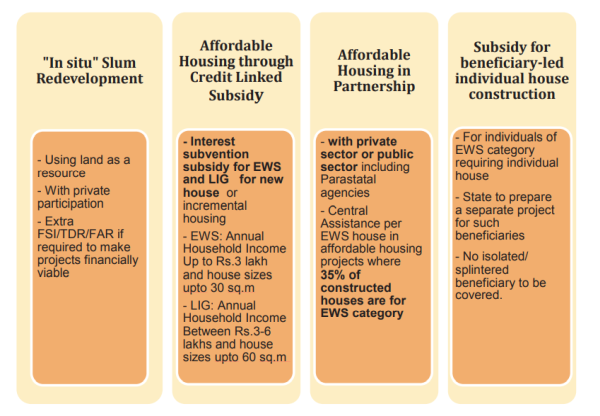

The Project is aimed for urban areas with following components/options to States/Union Territories and cities:-

1. Slum rehabilitation of Slum Dwellers with participation of private developers using land as a resource;

2. Promotion of affordable housing for weaker section through credit linked subsidy;

3. Affordable housing in partnership with Public & Private sectors and

4. Subsidy for beneficiary-led individual house construction or enhancement.

Affordable Housing through Credit Linked Subsidy is in respect of "households"

The scheme has defined beneficiary as

A beneficiary family will comprise husband, wife and unmarried children. The beneficiary family should not own a pucca house (an all weather dwelling unit) either in his/her name or in the name of any member of his/her family in any part of India.

Similarly, EWS households are defined as households having an annual income up to Rs.3,00,000 (Rupees Three Lakhs). States/UTs shall have the flexibility to redefine the annual income criteria as per local conditions in consultation with the Centre

LIG households are defined as households having an annual income between Rs.3,00,001 (Rupees Three Lakhs One) up to Rs.6,00,000 (Rupees Six Lakhs). States/UTs shall have the flexibility to redefine the annual income criteria as per local conditions in consultation with the Centre.

Slum has been defined as A compact area of at least 300 population or about 60-70 households of poorly built congested tenements, in unhygienic environment usually with inadequate infrastructure and lacking in proper sanitary and drinking water facilities.

Thus, only natural persons can be the beneficiary and the unit cannot be alloted to anyone other than an individual.

CAclubindia

CAclubindia